AdobeStock_263634914

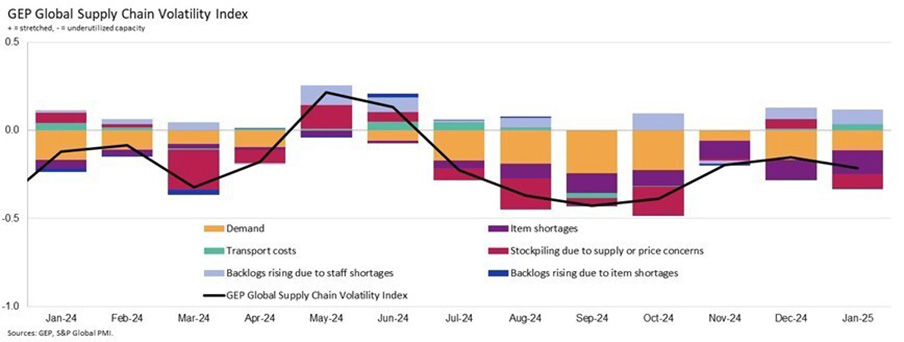

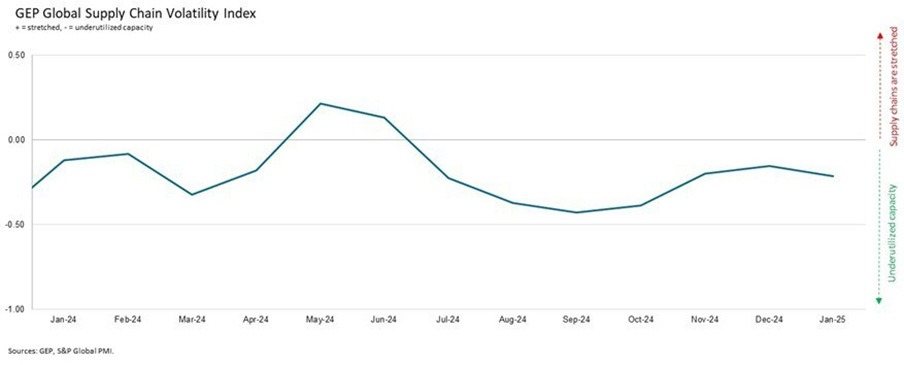

The GEP Global Supply Chain Volatility Index – a leading indicator tracking demand conditions, shortages, transportation costs, inventories, and backlogs based on a monthly survey of 27,000 businesses – posted -0.21 at the start of the year. This indicates that global supply chains are effectively at full capacity, signaled when the index hits 0.

"January's rise in manufacturers' procurement across APAC and the U.S. signals steady growth ahead in Q1," says John Piatek, GEP's vice president of consulting. "Globally, companies are largely taking a wait-and-see approach to tariffs rather than absorbing the immediate cost of increasing buffer inventories. However, many Western firms are accelerating China-plus-one investments to diversify and near-shore manufacturing, assembly, and distribution. European manufacturers are especially vulnerable, as the sector has been contracting for nearly two years with no turnaround in sight. In the U.S., where manufacturing represents just 12% of GDP, the bigger concern for business is the potential revenue losses in China because of trade tensions."

A key finding in January was the marked increase in procurement activity across North America. This increase was entirely driven by U.S. manufacturers, as purchasing managers at Mexican and Canadian factories sanctioned procurement cutbacks, indicating a darkened near-term outlook there.

In Asia, many major producers in the region bolstered their demand for inputs to meet growing production needs, led by China and India. South Korea, in particular, reported a marked pickup in January.

By contrast, Europe's industrial economy continues to struggle, with our data indicating still-significant levels of spare capacity across the continent's supply chains. Factories in Germany, France, Italy, and the U.K. held back on material purchases in January, implying that Europe's manufacturing recession is set to persist a while longer.

The Global Supply Chain Volatility Index data was captured just prior to the U.S. administration's announcement of tariffs on China, as well as the initial announcement (and subsequent pause) of tariffs on Mexico and Canada.

Interpreting the data

Index > 0, supply chain capacity is being stretched. The further above 0, the more stretched supply chains are.

Index < 0, supply chain capacity is being underutilized. The further below 0, the more underutilized supply chains are.

January 2025 key findings

Demand: After some pullback in the second half of 2024, global manufacturers' purchasing of raw materials is slowly recovering. In fact, global factory procurement in Asia is in line with its average, while in North America (driven by the U.S.), input purchasing is trending upward. This contrasts with the situation in Europe, which remains depressed as the region's industrial sector struggles to break out from its prolonged downturn.

Inventories: Global manufacturers' desire to safety stockpile remains contained. Reports from factories surveyed showing an increase in inventory levels due to concerns about price or supply were low in January.

Material Shortages: Reports of shortages for the globe's most critical items, such as commodities, electronic components, chemicals and food products, were at their lowest in five years during January. This suggests that suppliers remain well stocked, indicating there are minimal frictions for companies obtaining necessary materials.

Labor Shortages: Global factory employment levels have been shrinking for several months1 and it appears that the growing labor shortage is now preventing global suppliers from completing orders as quickly. There was a rise in reports of factory backlogs rising due to inadequate labor supply in January.

Transportation: Global transportation costs are increasing. In January, they rose to their highest level in six months.

Regional supply chain volatility

North America: Index up to -0.22, from -0.53, a six-month high, suggesting a pick-up in procurement across the region at the start of the year.

Europe: Index down to -0.61, from -0.49, suggesting that activity levels across Europe's supply chains remain weak.

U.K.: Index fell to -0.63, from -0.41 in December, a 13-month low and signaling a weaker outlook for 2025 for U.K. manufacturing.

Asia: Index rises to 0.03, from -0.09, indicating that suppliers to the region are generally operating at full capacity.

1 Source: The S&P Global PMI survey, which encompasses the GEP Global Supply Chain Volatility Index

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Latest from Today's Medical Developments

- Machine learning framework enhances precision, efficiency in metal 3D printing

- SkillMill – 60-year-old milling machine with digital twin

- Lumetrics’ OptiGauge II EMS

- EMI completes installation of 128-axis CNC turning & milling machine

- Ottobock invests in innovative technologies from MIT start-ups

- Air Turbine Technology's high-speed live tools for Swiss Lathes

- Sandvik announces several software acquisitions

- Dart Controls’s EZ VFD, variable frequency drives