USCTI

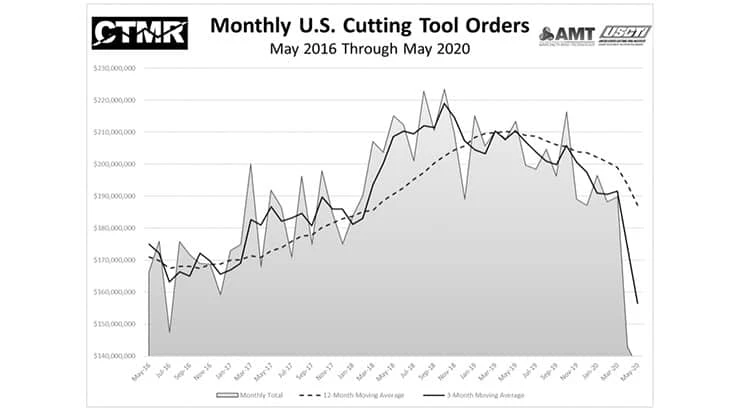

May 2020 U.S. cutting tool consumption totaled $136.6 million, according to the U.S. Cutting Tool Institute (USCTI) and the Association for Manufacturing Technology (AMT). This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 4.4% from April's $142.9 million and down 36% compared with the $213.4 million reported for May 2019. With a year-to-date total of $854.1 million, 2020 is down 18.8% when compared with May 2019.

“The cutting tool industry is doing its best to survive the effects of the forced pandemic recession that is resulting in a significant decline in shipments,” says Brad Lawton, Chairman of AMT’s Cutting Tool Product Group. “The questions are, when will we see recovery, in the third quarter or after the first week of November? And will we return to the sales volumes experienced in 2018 and 2019? Whatever the answers, the financial effects will be with the industry for an extended period.”

“The cutting tool market in May continued to shrink from April but at a much slower pace. We are now starting to see some market segments begin to stabilize and those segments should start to recover slowly in the months ahead,” says Phil Kurtz, Vice President of Business Development of Dormer Pramet. “It is very possible April and May will represent the bottom of the cycle, but considering the volatility of the current market only time will tell.”

“The cutting tool industry is doing its best to survive the effects of the forced pandemic recession that is resulting in a significant decline in shipments,” says Brad Lawton, Chairman of AMT’s Cutting Tool Product Group. “The questions are, when will we see recovery, in the third quarter or after the first week of November? And will we return to the sales volumes experienced in 2018 and 2019? Whatever the answers, the financial effects will be with the industry for an extended period.”

“The cutting tool market in May continued to shrink from April but at a much slower pace. We are now starting to see some market segments begin to stabilize and those segments should start to recover slowly in the months ahead,” says Phil Kurtz, Vice President of Business Development of Dormer Pramet. “It is very possible April and May will represent the bottom of the cycle, but considering the volatility of the current market only time will tell.”

Latest from Today's Medical Developments

- MedTech Innovator welcomes five new industry partners

- First Article Inspection for quality control

- The manufacturing resurgence is here – are you ready?

- Workholding solutions for your business

- ZOLLER events will showcase the company’s cutting-edge innovations

- THINBIT’s MINI GROOVE ‘N TURN Acme threading inserts

- CMMC Roll Out: When Do I Need to Comply? webinar

- Metabolic research uses Siemens gas analyzers to deliver results with 99.9999% resolutions