USCTI

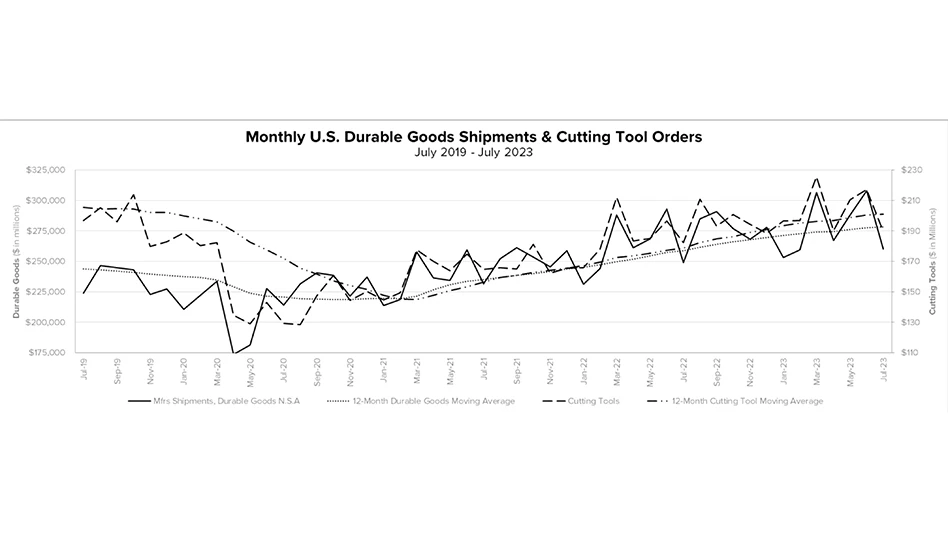

July 2023 U.S. cutting tool consumption totaled $189.6 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 12.7% from June’s $217.3 million and up 4% when compared with the $182.4 million reported for July 2022. With a year-to-date total of $1.43 billion, 2023 is up 9.4% when compared to the same period in 2022.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

“July is typically a slow month due to plant shutdowns and employee vacations. This year was no exception,” comments Jack Burley, chairman of AMT’s Cutting Tool Product Group. He further expanded, “Cutting tool consumption remains at a consistent level despite the news of declining activity in manufacturing. Automotive sales in 2023 have rebounded now that the supply chain issues have been mostly resolved. However, the recent labor dispute is likely to disrupt production for not only the big three but also for all supply chain partners, which may affect cutting tool usage later this year if it isn’t resolved quickly.”

Steve Stokey, executive vice president and owner of Allied Machine and Engineering, expressed similar sentiment, saying: “While July shipments are typically down compared to June, July 2023 had the steepest decline since 2016. The value of shipments through July is up nearly 10%, but unit shipments remain flat. This indicates that a good bit of the growth we are seeing is due to the lingering effects of inflation in the cutting tool market. The onset of the autoworker strike as well as continued high interest rates may cause the industry to proceed cautiously for the remainder of the year.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

Latest from Today's Medical Developments

- Arcline to sell Medical Manufacturing Technologies to Perimeter Solutions

- Decline in German machine tool orders bottoming out

- Analysis, trends, and forecasts for the future of additive manufacturing

- BlueForge Alliance Webinar Series Part III: Integrate Nationally, Catalyze Locally

- Robot orders accelerate in Q3

- Pro Shrink TubeChiller makes shrink-fit tool holding safer, easier

- Revolutionizing biocompatibility: The role of amnion in next-generation medical devices

- #56 Lunch + Learn Podcast with Techman Robot + AMET Inc.