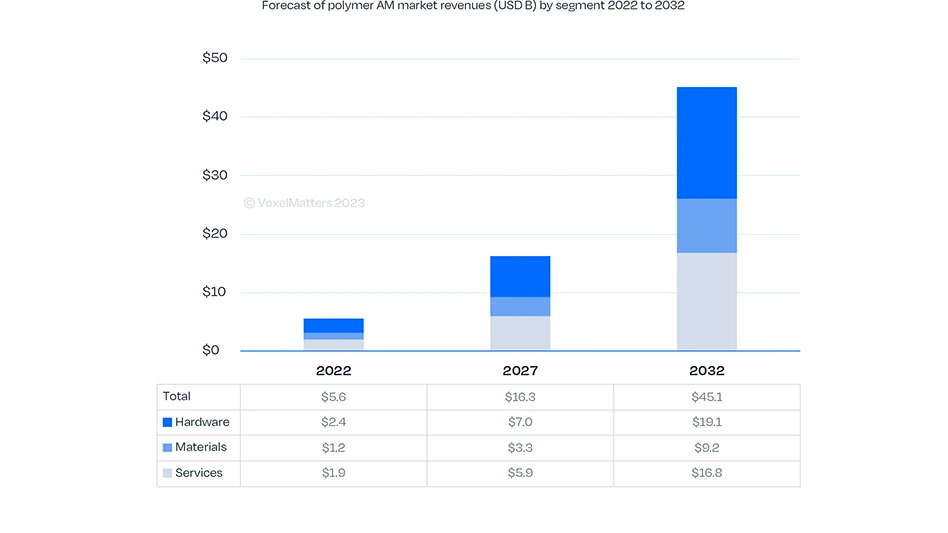

CREDIT: VoxelMatters Research

VoxelMatters Research, a leading market analysis company specializing in tracking the global additive manufacturing (AM) industry, released its new study on polymer additive manufacturing. The new report, Polymer AM Market 2023, was compiled during 2023 and looks at the last full calendar year (2022) to reveal that the market for polymer AM hardware, materials, and services generated $5.6 billion in 2022, growing by 19% year-on-year. The report forecasts the Core Polymer AM market to grow into a $45 billion yearly revenue opportunity by 2032, at a 23.3% CAGR.

Some key findings

The new data confirms the growth predictions made in the previous edition of this report, with all three core AM polymer segments now generating over $1 billion in yearly revenues. These figures are significant for the AM market, indicating growth in both part size and batch size. This trend is further analyzed and demonstrated in this report.

Compared to the forecast published in the previous edition of this report, there have been some adjustments to the CAGR forecast. The forecast for hardware has been slightly reduced due to slowdowns in hardware sales, while the forecast for AM services has been increased due to new companies entering the market and a general tendency for adopting companies to rely on service providers to avoid high initial CapEx. All segments are now expected to grow at similar rates during the 10-year forecast period, ranging between 22.8% and 23.8%. The AM services segment is projected to be the fastest-growing in this updated analysis.

In 2022, the industrial, automotive, consumer, and dental verticals were the four most significant sectors contributoring to the total revenue of the core polymer AM market. These four sectors accounted for nearly half (48%) of the market. Their impact will remain significant, as they are expected to account for approximately 50% of the total core polymer AM market by the end of the forecast period in 2032.

In terms of regions, North America (NA) was the largest region in terms of revenue in 2022. It is projected to grow from $2.3 billion to $16.6 billion, with a CAGR of 21.8%, and remain the largest region in 2032. The EMEA region is expected to grow from $1.8 billion to $15.8 billion, and the Asia-Pacific (APAC) region is set to rise from $1.4 billion to $12.4 billion.

About the report

The new Polymer AM 2023 market report spans over 450 pages and includes nearly 200 charts and data tables, focusing on all polymer technologies and materials used in additive manufacturing to produce prototypes, tools, and end-use parts across various key industrial segments such as aerospace, automotive, medical, dental, energy, and consumer products.

By leveraging VoxelMatters Directory – the largest global directory of verified AM companies, currently consisting of nearly 7,000 companies – the research team identified 233 hardware manufacturers, 211 material suppliers, and 455 service providers (including 42 new companies from the previous edition). In total, the underlying dataset for this market study comprises over 190,000 data points.

The report addresses both leading and emerging companies, including 3D Systems, 3DXTECH, Airtech, Anycubic, Arkema, BASF, Bambu Lab, Caracol, Carbon, CMS, Creality, CRP, ETEC (Desktop Metal), EOS, Evonik, FIT, Flashforge, Formlabs, Forecast3D, HP, Jabil Additive, Markforged, Materialise, Mitsubishi MCPP, OECHSLER, Photocentric, Polymaker, Protolabs, Prototal, Prusa Research, Quickparts, SABIC, Shapeways, Solvay, Stratasys, Ultimaker, UnionTech & UnionFab, and WeNext.

In addition to supporting the market analysis and development efforts of existing suppliers, the report is aimed at companies seeking to enter the market and take advantage of emerging opportunities. OEMs looking to implement AM for polymer part production will benefit from this study by quickly and accurately understanding the technologies, materials, and services currently available, as well as the benefits and challenges associated with each. Finally, this document serves as a guide for investors seeking the next disruptive production technologies.

Latest from Today's Medical Developments

- Auxilium Biotechnologies prints medical devices on the International Space Station

- KYOCERA SGS Precision Tools’ APEX Application Expert

- North American robotics market holds steady in 2024 amid sectoral variability

- Evident’s DSX2000 digital microscope

- Ferrocene becomes first Rust toolchain to achieve IEC 62304 qualification

- Germany expects a major decline in production in 2025

- Learn what you need to comply with CMMC requirements

- VersaBuilt’s CNC automation possibilities