Association for Advancing Automation

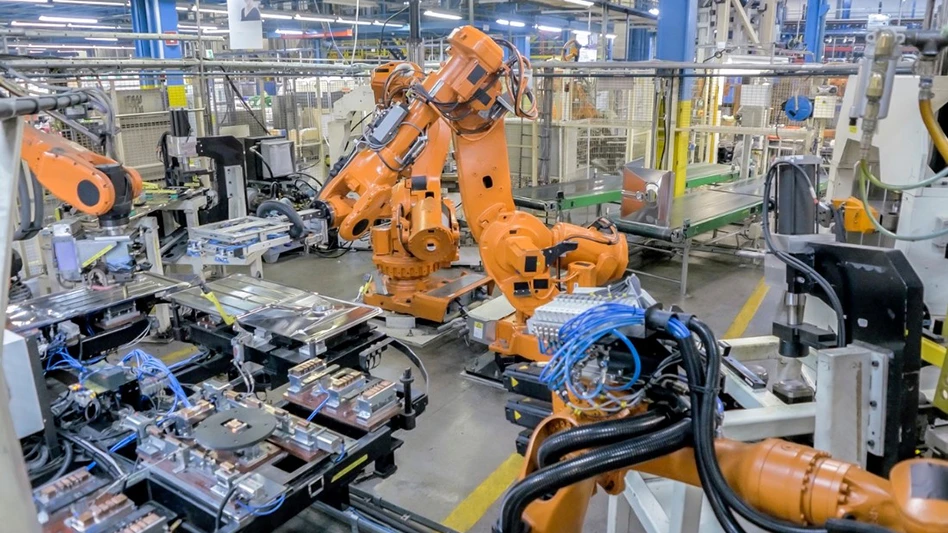

A slow U.S. economy and high interest rates have taken a toll on robot orders in North American, resulting in a decline for the second quarter in a row after record purchases in 2021 and 2022. According to the latest report from the Association for Advancing Automation (A3), companies ordered 7,697 robots valued at $457 million from April to July 2023, a 37% decline in robot orders and 20% drop in value over the same period in 2022.

When combined with Q1 results, the robotics market in North America is down 29% compared to the first half of last year with a total of 16,865 robots ordered. This drop comes after a record 2022, where North American companies ordered 44,196 robots, up 11% over 2021, the previous record.

“Over the last five years, we’ve seen a steady acceleration of robot orders as all industries have struggled with a labor shortage and more non-automotive companies recognize the tremendous value automation provides,” says Alex Shikany, vice president of membership and business intelligence, A3. “After this post-COVID surge, however, we’re seeing a drawback in purchases, exacerbated by the slow economy and high interest rates. While many companies continue to automate, others just don’t have the capital to invest right now, despite their struggle to find workers willing to do many of the dull, dirty, and dangerous jobs that remain unfilled.”

The ongoing labor shortage, especially in manufacturing (down another 2,000 jobs in July, according to the U.S. Bureau of Labor Statistics) remains a key driver of automation. An increasing trend towards reshoring tasks here in North America is another contributing factor.

“Record attendance at tradeshows such as Automate in Detroit this year show even greater interest in robotics and automation than ever before, but as these numbers show, not all are ready or able to pull the trigger just yet,” says Jeff Burnstein, president of A3. “When the economy improves, however, the companies who have learned about the latest innovations in automation and how they can help them increase productivity, deal with labor shortages and get to market faster will be ready.”

Automotive vs. Non-automotive ordering at more equal rates

Non-automotive customers ordered more robots in the second quarter of 2023 than automotive customers, with 52% of units going to non-automotive industries and 48% going to automotive OEMs and component suppliers. Both categories were down compared to the second quarter of last year, however, with non-automotive orders down 21% and automotive orders down 49%. The strongest demand in Q2 came from the semiconductor & electronics industries, followed by life sciences/pharma and biomedical, plastics & rubber and metals, with automotive components, food & consumer goods, and automotive OEMs showing the biggest drops.

AI and robot safety – Pittsburgh this October

Those interested in robot safety or artificial intelligence (AI) and smart computing can learn the latest at the International Robot Safety Conference and AI & Smart Automation Conference, co-located in Pittsburgh the week of October 9.

Latest from Today's Medical Developments

- Auxilium Biotechnologies prints medical devices on the International Space Station

- KYOCERA SGS Precision Tools’ APEX Application Expert

- North American robotics market holds steady in 2024 amid sectoral variability

- Evident’s DSX2000 digital microscope

- Ferrocene becomes first Rust toolchain to achieve IEC 62304 qualification

- Germany expects a major decline in production in 2025

- Learn what you need to comply with CMMC requirements

- VersaBuilt’s CNC automation possibilities