Cleveland, Ohio – The global medical device outsourcing market is expected to grow with CAGR of 11.5% throughout the forecast period.

Rising competition among manufacturers leading to development of products at lower cost is one of the key factors attributing towards growth over the forecast period. Furthermore, growing complexities in product engineering coupled with increasing number of entrant manufacturers are expected to propel the medical device outsourcing industry with lucrative growth opportunities.

U.S. medical device outsourcing market, by service, 2014 - 2025 (USD Million)

Rising geriatric population is predicted to increase demand for medical devices and supplies forming a large customer base with limited health resources, thereby pushing manufacturers towards subcontracting of activities such as assembling, packaging, and others. For instance, new entrants of the industry are anticipated to outsource device designing in order to be technologically updated and meet the demands of the patients over the forecast period.

In addition, emphasis by regulatory bodies to maintain quality of healthcare devices provided to the public is rapidly becoming stringent and cumbersome to handle. In order to combat the situation, services such as regulatory consulting are being availed by industry players. For instance, the European Medical Device Regulation (EMDR) under take special unannounced scrutiny of outsourced products to check for quality and conformity with the standards.

Application insights

On the basis of application, the medical device outsourcing industry is segmented into Class I, Class II, and Class III devices. These class have been further represented on the basis of therapeutics in the report. For instance, the market share for cardiology device based on application has been provided in the report.

Generally, Class II devices are predicted to represent majority of the share with about 48.4%. Maximum number of medical device fall into this category including infusion pumps, wheelchairs, surgical drapes, and X-ray machine.

Rising number of surgical procedures and complexity of device designing are high impact rendering driver for this growth. Class II are outsourced for designing, manufacturing, sales and marketing, clinical and advisory services, and after sales services.

Advantages such as concentration on core competency, cost efficiency, and accelerated time to market are expected to be the vital impact rendering drivers, promoting higher subcontracting by manufacturers of these devices.

Service insights

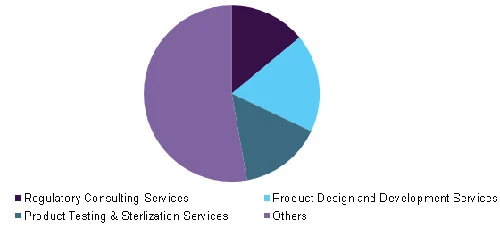

Key services offered by the medical device outsourcing market include; regulatory consulting, product design and development, product testing, product implementation, product upgrade, and product maintenance. Regulatory consulting services are likely to witness increasing demand over the forecast period owing to rising awareness of timely filing and auditing of the regulatory documents.

The product design and development segment is expected to witness lucrative growth during the forecast period and it held more than 15.0% of the share in 2016. However, contract manufacturing services are expected to be the fastest growing over the next seven years with a CAGR of over 11.5%.

Therapeutic insights

Key therapeutic segments catered to include; cardiology, diagnostic imaging, in-vitro diagnostic (IVD), orthopedic, dental, drug delivery, general and plastic surgery, endoscopy, ophthalmic, and diabetes care. Cardiology segment is likely to witness lucrative growth during the forecast period due to increases incidences of associated conditions.

General & plastic surgery segment is anticipated witness the most lucrative growth in the next seven years. Rising number of injuries to bones, joints, and tissues, and augmenting incidences of chronic conditions are certain impact rendering drivers anticipated to propel this growth.

Global medical device outsourcing market, by service, 2015

Regional insights

Asia Pacific dominates the medical device outsourcing industry and held over 40.0% of the revenue share in 2014. This revenue is based on destination country emphasizing the rising outsourcing activity within the Asia Pacific.

However, in terms of source country, North America dominates the market. This is attributed to the strong manufacturing hubs for reliable, complex, and high-end medical devices. Consequently, Original Equipment Manufacturers (OEMs) are increasingly moving towards electronics manufacturing service providers to efficiently handle increasing volume of electronic content in the current products.

Competitive insights

Key players operating in the medical device outsourcing industry include Kinetics Climax Inc., Shandong Weigao Co. Ltd., Daiichi Jitsugyo Co. Ltd., CFI Medical, Infinity Plastics Group, ProMed Molded Products Inc., Sterigenics International Inc., GE Healthcare, Accellent Inc., Mitutoyo Corp., Omnica Corp., Cirtec Medical, and Micro Systems Engineering GmbH.

Numerous companies are expected to enter this market during the forecast period owing to the rising demand for these devices across the globe. This is expected to raise the level of competition over the next seven years.

Furthermore, collaborations between existing players and niche service offerings to enhance quality and competency may also be predicted to occur over the forecast period. The established players of the medical device outsourcing industry are anticipated to widen their portfolio and provide one-stop shop options to combat the aggressive competition during the forecast period. For instance, in 2015, Cirtec Medical announced its expansion by opening of a new manufacturing facility in Enfield, Conn.

Segments covered in the report

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the medical device outsourcing market on the basis of application, service, therapeutic area and region:

Application outlook (revenue, USD million, 2014 - 2025)

- Class I

- Class II

- Class III

Service outlook (revenue, USD million, 2014 - 2025)

- Regulatory consulting services

- Clinical trials applications and product registrations

- Regulatory writing and publishing

- Legal representation

- Other

- Product design and development services

- Designing & engineering

- Machining

- Molding

- Packaging

- Product testing & sterilization services

- Product implementation services

- Product upgrade services

- Product maintenance services

- Contract manufacturing

- Accessories manufacturing

- Assembly manufacturing

- Component manufacturing

- Device manufacturing

Therapeutic outlook (revenue, USD million, 2014 - 2025)

- Cardiology

- Diagnostic imaging

- Orthopedic

- IVD

- Ophthalmic

- General and plastic surgery

- Drug delivery

- Dental

- Endoscopy

- Diabetes care

- Others

Regional outlook (revenue, USD million, 2014 - 2025)

- North America

- U.S.

- Canada

- Europe

- France

- Germany

- Asia Pacific

- Japan

- China

- India

- Latin America

- Brazil

- Mexico

- Middle East and Africa (MEA)

- South Africa

Source: Grand View Research

Latest from Today's Medical Developments

- IMTS 2026 runs Sept. 14-19 at McCormick Place in Chicago, Illinois

- Master Bond’s MasterSil 800Med

- ZEISS celebrates 100 years of advancing innovation in the US

- Teleflex sells acute care and urology businesses for $2.03 billion

- HANNOVER MESSE: Where research and manufacturing meet

- What’s next for the design and manufacturing industry in 2026?

- Arcline to sell Medical Manufacturing Technologies to Perimeter Solutions

- Decline in German machine tool orders bottoming out