Vancouver, British Columbia – According to a recently published report by iData Research, the motion preservation device market is the fastest growing segment within the U.S. spinal implant market. This increase is fueled by the rapid growth of new spine devices like cervical artificial discs (CAD) and lumbar artificial discs (LAD).

“As the spinal implant market grows in size, more competitors are entering the markets and broadening their portfolios with new products including motion preservation implants,” explains Dr. Kamran Zamanian, CEO of iData. “Artificial discs are becoming an alternative to procedures with poor patient outcomes, such as spinal fusion. This explains the increased demand for both cervical and lumbar discs.”

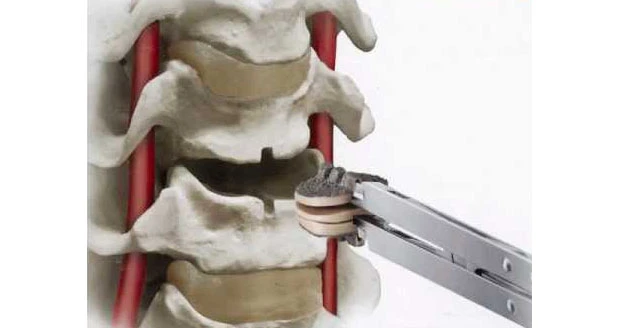

Artificial discs attempt to restore or maintain the natural motion of the human spine, while a fusion procedure limits motion almost entirely. When given the choice between a fusion and a motion-preserving device, patients generally prefer motion-preserving devices. Spinal fusion also increases the risk of a second fusion or revision surgery due to adjacent vertebral level complications.

These new improvements to CAD will allow the market to exhibit high growth. Additionally, insurance companies in the U.S. have begun coverage for cervical disc replacement procedures. The improved reimbursement policies will continue to facilitate growth in the CAD market. However, because of their increased popularity, CADs will ultimately begin to cannibalize a significant portion of the spinal fusion market over the forecast period.

The leading competitor in the market, DePuy Synthes holds nearly 50% market share in the US motion preservation market due to the company’s strength in the LAD and CAD markets. They are the only company with both a CAD and a LAD device on the US market. DePuy Synthes is currently the only company and the sole competitor in the US market with an approved LAD device. However, DePuy Synthes’ position will be challenged in the future with the emergence of many new competitors and products as well as second-generation devices, such as those from AxioMed and Spinal Kinetics.

Other notable competitors in the US motion preservation device market include Medtronic, LDR, Globus Medical, Paradigm Spine, and NuVasive among others.

The global series on the spinal implant and VCF markets covers the U.S., Australia, Japan, South Korea, China, Taiwan, and 15 countries in Europe. Full reports provide a comprehensive analysis including units sold, procedure numbers, market value, forecasts, as well as detailed competitive market shares and analysis of major players’ success strategies in each market and segment.

Source: iData Research

Latest from Today's Medical Developments

- Arcline to sell Medical Manufacturing Technologies to Perimeter Solutions

- Decline in German machine tool orders bottoming out

- Analysis, trends, and forecasts for the future of additive manufacturing

- BlueForge Alliance Webinar Series Part III: Integrate Nationally, Catalyze Locally

- Robot orders accelerate in Q3

- Pro Shrink TubeChiller makes shrink-fit tool holding safer, easier

- Revolutionizing biocompatibility: The role of amnion in next-generation medical devices

- #56 Lunch + Learn Podcast with Techman Robot + AMET Inc.