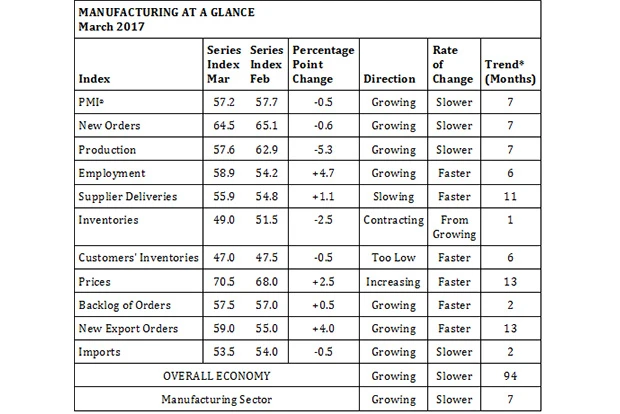

Economic activity in the manufacturing sector expanded in March, and the overall economy grew for the 94th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee: "The March PMI registered 57.2%, a decrease of 0.5 percentage point from the February reading of 57.7%. The New Orders Index registered 64.5%, a decrease of 0.6 percentage point from the February reading of 65.1%. The Production Index registered 57.6%, 5.3 percentage points lower than the February reading of 62.9%. The Employment Index registered 58.9%, an increase of 4.7 percentage points from the February reading of 54.2%. Inventories of raw materials registered 49%, a decrease of 2.5 percentage points from the February reading of 51.5%. The Prices Index registered 70.5% in March, an increase of 2.5 percentage points from the February reading of 68%, indicating higher raw materials prices for the 13th consecutive month. Consistent with generally positive comments from the panel, all 18 industries reported growth in new orders for the month of March."

Of the 18 manufacturing industries, 17 reported growth in March in the following order: Electrical Equipment, Appliances & Components; Printing & Related Support Activities; Furniture & Related Products; Textile Mills; Machinery; Primary Metals; Miscellaneous Manufacturing; Wood Products; Nonmetallic Mineral Products; Plastics & Rubber Products; Paper Products; Transportation Equipment; Chemical Products; Computer & Electronic Products; Food, Beverage & Tobacco Products; Fabricated Metal Products; and Petroleum & Coal Products. No industry reported contraction in March compared to February.

| MANUFACTURING AT A GLANCE | ||||||

|

| Series | Series | Percentage |

| Rate |

|

| PMI | 57.2 | 57.7 | -0.5 | Growing | Slower | 7 |

| New Orders | 64.5 | 65.1 | -0.6 | Growing | Slower | 7 |

| Production | 57.6 | 62.9 | -5.3 | Growing | Slower | 7 |

| Employment | 58.9 | 54.2 | +4.7 | Growing | Faster | 6 |

| Supplier Deliveries | 55.9 | 54.8 | +1.1 | Slowing | Faster | 11 |

| Inventories | 49.0 | 51.5 | -2.5 | Contracting | From | 1 |

| Customers' Inventories | 47.0 | 47.5 | -0.5 | Too Low | Faster | 6 |

| Prices | 70.5 | 68.0 | +2.5 | Increasing | Faster | 13 |

| Backlog of Orders | 57.5 | 57.0 | +0.5 | Growing | Faster | 2 |

| New Export Orders | 59.0 | 55.0 | +4.0 | Growing | Faster | 13 |

| Imports | 53.5 | 54.0 | -0.5 | Growing | Slower | 2 |

| OVERALL ECONOMY | Growing | Slower | 94 | |||

| Manufacturing Sector | Growing | Slower | 7 | |||

Manufacturing ISM Report On Business data is seasonally adjusted for the New Orders, Production, Employment and Supplier Deliveries Indexes.

*Number of months moving in current direction.

COMMODITIES REPORTED UP/DOWN IN PRICE AND IN SHORT SUPPLY

Commodities up in price

Acetone; Acrylates; Aluminum (5); Butadiene (3); Caustic Soda (2); Copper (5); Corrugate (6); Corrugated Boxes; Corrugated Packaging; Foam; HDPE; Nylon; Plastic Resin; Polypropylene (2); Rubber — Natural (2); Scrap Metal (2); Stainless Steel (12); Steel (15); Steel Tubing (2); Steel — Carbon (4); Steel — Cold Rolled (5); Steel — Hot Rolled (4); and Titanium Dioxide (4).

Commodities down in price

None.

Commodities in short supply

Capacitors; Electronic Components; and Methacrylates.

Note: The number of consecutive months the commodity is listed is indicated after each item.

MARCH 2017 MANUFACTURING INDEX SUMMARIES

PMI

Manufacturing expanded in March as the PMI registered 57.2 percent, a decrease of 0.5 percentage point from the February reading of 57.7 percent, indicating growth in manufacturing for the seventh consecutive month. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

A PMI above 43.3 percent, over a period of time, generally indicates an expansion of the overall economy. Therefore, the March PMI indicates growth for the 94th consecutive month in the overall economy and the seventh straight month of growth in the manufacturing sector. Holcomb stated, "The past relationship between the PMI and the overall economy indicates that the average PMI for January through March (57 percent) corresponds to a 4.3 percent increase in real gross domestic product (GDP) on an annualized basis. In addition, if the PMI for March (57.2 percent) is annualized, it corresponds to a 4.4 percent increase in real GDP annually."

THE LAST 12 MONTHS

| Month | PMI | Month | PMI | |

| Mar 2017 | 57.2 | Sep 2016 | 51.7 | |

| Feb 2017 | 57.7 | Aug 2016 | 49.4 | |

| Jan 2017 | 56.0 | Jul 2016 | 52.3 | |

| Dec 2016 | 54.5 | Jun 2016 | 52.8 | |

| Nov 2016 | 53.5 | May 2016 | 51.0 | |

| Oct 2016 | 52.0 | Apr 2016 | 50.7 | |

| Average for 12 months – 53.2 | ||||

New orders

ISM's New Orders Index registered 64.5% in March, which is a decrease of 0.6 percentage point when compared to the 65.1% reported for February, indicating growth in new orders for the seventh consecutive month. A New Orders Index above 52.3%, over time, is generally consistent with an increase in the Census Bureau's series on manufacturing orders (in constant 2000 dollars).

All 18 industries reported growth in new orders in March, listed in the following order: Wood Products; Printing & Related Support Activities; Electrical Equipment, Appliances & Components; Apparel, Leather & Allied Products; Paper Products; Plastics & Rubber Products; Primary Metals; Furniture & Related Products; Machinery; Nonmetallic Mineral Products; Transportation Equipment; Miscellaneous Manufacturing; Textile Mills; Chemical Products; Computer & Electronic Products; Fabricated Metal Products; Petroleum & Coal Products; and Food, Beverage & Tobacco Products.

| New | % | % | % |

|

|

| Mar 2017 | 45 | 45 | 10 | +35 | 64.5 |

| Feb 2017 | 42 | 48 | 10 | +32 | 65.1 |

| Jan 2017 | 32 | 52 | 16 | +16 | 60.4 |

| Dec 2016 | 32 | 48 | 20 | +12 | 60.3 |

Production

ISM's Production Index registered 57.6% in March, which is a decrease of 5.3 percentage points when compared to the 62.9% reported for February, indicating growth in production for the seventh consecutive month. An index above 51.4%, over time, is generally consistent with an increase in the Federal Reserve Board's Industrial Production figures.

The 17 industries reporting growth in production during the month of March — listed in order — are: Textile Mills; Apparel, Leather & Allied Products; Electrical Equipment, Appliances & Components; Furniture & Related Products; Miscellaneous Manufacturing; Machinery; Printing & Related Support Activities; Nonmetallic Mineral Products; Fabricated Metal Products; Primary Metals; Transportation Equipment; Chemical Products; Petroleum & Coal Products; Plastics & Rubber Products; Paper Products; Food, Beverage & Tobacco Products; and Computer & Electronic Products. No industry reported a decrease in March compared to February.

|

| % | % | % |

|

|

| Mar 2017 | 34 | 53 | 13 | +21 | 57.6 |

| Feb 2017 | 37 | 53 | 10 | +27 | 62.9 |

| Jan 2017 | 32 | 50 | 18 | +14 | 61.4 |

| Dec 2016 | 28 | 55 | 17 | +11 | 59.4 |

Employment

ISM's Employment Index registered 58.9% in March, an increase of 4.7 percentage points when compared to the February reading of 54.2%, indicating growth in employment in March for the sixth consecutive month. This is the highest reading since June 2011, when the Employment Index registered 61.3 percent. An Employment Index above 50.5%, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

Of the 18 manufacturing industries, the 14 reporting employment growth in March — listed in order — are: Electrical Equipment, Appliances & Components; Printing & Related Support Activities; Furniture & Related Products; Nonmetallic Mineral Products; Primary Metals; Paper Products; Machinery; Transportation Equipment; Food, Beverage & Tobacco Products; Computer & Electronic Products; Plastics & Rubber Products; Fabricated Metal Products; Miscellaneous Manufacturing; and Chemical Products. The three industries reporting a decrease in employment in March are: Apparel, Leather & Allied Products; Petroleum & Coal Products; and Textile Mills.

|

| % | % | % |

|

|

| Mar 2017 | 27 | 62 | 11 | +16 | 58.9 |

| Feb 2017 | 21 | 66 | 13 | +8 | 54.2 |

| Jan 2017 | 21 | 66 | 13 | +8 | 56.1 |

| Dec 2016 | 15 | 73 | 12 | +3 | 52.8 |

Supplier deliveries

The delivery performance of suppliers to manufacturing organizations was slower in March, as the Supplier Deliveries Index registered 55.9%, which is 1.1 percentage points higher than the 54.8% reported for February. A reading below 50% indicates faster deliveries, while a reading above 50% indicates slower deliveries.

The 12 industries reporting slower supplier deliveries in March — listed in order — are: Textile Mills; Machinery; Electrical Equipment, Appliances & Components; Food, Beverage & Tobacco Products; Chemical Products; Petroleum & Coal Products; Nonmetallic Mineral Products; Plastics & Rubber Products; Computer & Electronic Products; Miscellaneous Manufacturing; Transportation Equipment; and Fabricated Metal Products. Six industries reported no change in supplier deliveries in March compared to February. No industry reported faster supplier deliveries in March compared to February.

| Supplier | % | % | % |

|

|

| Mar 2017 | 16 | 81 | 3 | +13 | 55.9 |

| Feb 2017 | 16 | 79 | 5 | +11 | 54.8 |

| Jan 2017 | 12 | 84 | 4 | +8 | 53.6 |

| Dec 2016 | 9 | 86 | 5 | +4 | 53.0 |

Inventories*

The Inventories Index registered 49% in March, which is a decrease of 2.5 percentage points when compared to the 51.5% reported for February, indicating raw materials inventories are contracting in March. An Inventories Index greater than 42.9%, over time, is generally consistent with expansion in the Bureau of Economic Analysis (BEA) figures on overall manufacturing inventories (in chained 2000 dollars).

The eight industries reporting higher inventories in March — listed in order — are: Textile Mills; Furniture & Related Products; Printing & Related Support Activities; Electrical Equipment, Appliances & Components; Primary Metals; Miscellaneous Manufacturing; Food, Beverage & Tobacco Products; and Computer & Electronic Products. The six industries reporting lower inventories in March — listed in order — are: Apparel, Leather & Allied Products; Fabricated Metal Products; Nonmetallic Mineral Products; Transportation Equipment; Chemical Products; and Machinery.

|

| % | % | % |

|

|

| Mar 2017 | 18 | 62 | 20 | -2 | 49.0 |

| Feb 2017 | 19 | 65 | 16 | +3 | 51.5 |

| Jan 2017 | 18 | 61 | 21 | -3 | 48.5 |

| Dec 2016 | 17 | 60 | 23 | -6 | 47.0 |

Customers' inventories*

ISM's Customers' Inventories Index registered 47% in March, which is 0.5 percentage point lower than the 47.5%reported for February, indicating that customers' inventory levels are considered too low in March for the sixth consecutive month.

The two manufacturing industries reporting customers' inventories as being too high during the month of March are: Primary Metals; and Transportation Equipment. The nine industries reporting customers' inventories as too low during March — listed in order — are: Textile Mills; Apparel, Leather & Allied Products; Plastics & Rubber Products; Paper Products; Chemical Products; Machinery; Fabricated Metal Products; Food, Beverage & Tobacco Products; and Computer & Electronic Products. Six industries reported no change in customer inventories in March compared to February.

| Customers' | % | %Too | %About | %Too |

|

|

| Mar 2017 | 53 | 14 | 66 | 20 | -6 | 47.0 |

| Feb 2017 | 53 | 15 | 65 | 20 | -5 | 47.5 |

| Jan 2017 | 58 | 13 | 71 | 16 | -3 | 48.5 |

| Dec 2016 | 54 | 12 | 74 | 14 | -2 | 49.0 |

Prices*

The ISM Prices Index registered 70.5% in March, an increase of 2.5 percentage points when compared to the February reading of 68%, indicating an increase in raw materials prices for the 13th consecutive month. The March reading is the highest since May 2011, when the Prices Index registered 76.5%. In March, 47% of respondents reported paying higher prices, 6% reported paying lower prices, and 47 percent of supply executives reported paying the same prices as in February. A Prices Index above 52.4%, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) Producer Price Index for Intermediate Materials.

Of the 18 manufacturing industries, the 16 that reported paying increased prices for its raw materials in March — listed in order — are: Apparel, Leather & Allied Products; Plastics & Rubber Products; Electrical Equipment, Appliances & Components; Textile Mills; Fabricated Metal Products; Primary Metals; Paper Products; Chemical Products; Machinery; Miscellaneous Manufacturing; Food, Beverage & Tobacco Products; Nonmetallic Mineral Products; Transportation Equipment; Furniture & Related Products; Computer & Electronic Products; and Petroleum & Coal Products. No industry reported paying lower prices during the month of March compared to February.

|

| % | % | % |

|

|

| Mar 2017 | 47 | 47 | 6 | +41 | 70.5 |

| Feb 2017 | 41 | 54 | 5 | +36 | 68.0 |

| Jan 2017 | 44 | 50 | 6 | +38 | 69.0 |

| Dec 2016 | 38 | 55 | 7 | +31 | 65.5 |

Backlog of orders*

ISM's Backlog of Orders Index registered 57.5% in March, an increase of 0.5 percentage point from the 57% reported for February, indicating growth in order backlogs for the second consecutive month. Of the 89 percent of respondents who reported their backlog of orders, 27% reported greater backlogs, 12% reported smaller backlogs, and 61% reported no change from February.

The 13 industries reporting growth in order backlogs in March — listed in order — are: Textile Mills; Wood Products; Furniture & Related Products; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; Transportation Equipment; Machinery; Nonmetallic Mineral Products; Paper Products; Computer & Electronic Products; Chemical Products; Fabricated Metal Products; and Primary Metals. The only industry reporting a decrease in order backlogs during March is Miscellaneous Manufacturing.

| Backlog of | % | % | % | % |

|

|

| Mar 2017 | 89 | 27 | 61 | 12 | +15 | 57.5 |

| Feb 2017 | 88 | 26 | 62 | 12 | +14 | 57.0 |

| Jan 2017 | 89 | 21 | 57 | 22 | -1 | 49.5 |

| Dec 2016 | 88 | 21 | 56 | 23 | -2 | 49.0 |

New export orders*

ISM's New Export Orders Index registered 59% in March, an increase of 4 percentage points when compared to the 55% reported for February, indicating growth in new export orders for the 13th consecutive month. This is the highest reading since November 2013, when the index registered 59.5%.

The 11 industries reporting growth in new export orders in March — listed in order — are: Wood Products; Furniture & Related Products; Transportation Equipment; Chemical Products; Paper Products; Computer & Electronic Products; Electrical Equipment, Appliances & Components; Food, Beverage & Tobacco Products; Fabricated Metal Products; Machinery; and Miscellaneous Manufacturing. The only industry reporting a decrease in new export orders during March is Plastics & Rubber Products. Six industries reported no change in new export orders in March compared to February.

| New Export | % | % | % | % |

|

|

| Mar 2017 | 78 | 23 | 72 | 5 | +18 | 59.0 |

| Feb 2017 | 80 | 16 | 78 | 6 | +10 | 55.0 |

| Jan 2017 | 80 | 15 | 79 | 6 | +9 | 54.5 |

| Dec 2016 | 80 | 17 | 78 | 5 | +12 | 56.0 |

Imports*

ISM's Imports Index registered 53.5% in March, a decrease of 0.5 percentage point when compared to the 54%reported for February, indicating that imports are growing in March for the second consecutive month.

The 10 industries reporting growth in imports during the month of March — listed in order — are: Textile Mills; Paper Products; Furniture & Related Products; Fabricated Metal Products; Nonmetallic Mineral Products; Electrical Equipment, Appliances & Components; Chemical Products; Transportation Equipment; Miscellaneous Manufacturing; and Computer & Electronic Products. The four industries reporting a decrease in imports during March are: Apparel, Leather & Allied Products; Plastics & Rubber Products; Machinery; and Food, Beverage & Tobacco Products.

|

| % | % | % | % |

|

|

| Mar 2017 | 81 | 15 | 77 | 8 | +7 | 53.5 |

| Feb 2017 | 83 | 14 | 80 | 6 | +8 | 54.0 |

| Jan 2017 | 81 | 11 | 78 | 11 | 0 | 50.0 |

| Dec 2016 | 83 | 10 | 81 | 9 | +1 | 50.5 |

* The Inventories, Customers' Inventories, Prices, Backlog of Orders, New Export Orders and Imports Indexes do not meet the accepted criteria for seasonal adjustments.

Buying policy

Average commitment lead time for Capital Expenditures decreased in March by 1 day to 140 days. Average lead time for Production Materials decreased by 2 days to 59 days. Average lead time for Maintenance, Repair and Operating (MRO) Supplies decreased by 2 days to 31 days.

| Percent Reporting | |||||||

|

| Hand- |

|

|

|

|

|

|

| Mar 2017 | 20 | 7 | 11 | 17 | 26 | 19 | 140 |

| Feb 2017 | 19 | 7 | 11 | 18 | 26 | 19 | 141 |

| Jan 2017 | 19 | 8 | 12 | 16 | 26 | 19 | 140 |

| Dec 2016 | 19 | 9 | 11 | 18 | 24 | 19 | 138 |

|

| Hand- |

|

|

|

|

|

|

| Mar 2017 | 15 | 37 | 26 | 15 | 4 | 3 | 59 |

| Feb 2017 | 16 | 34 | 27 | 15 | 5 | 3 | 61 |

| Jan 2017 | 14 | 33 | 26 | 17 | 7 | 3 | 65 |

| Dec 2016 | 14 | 40 | 19 | 17 | 6 | 4 | 65 |

|

| Hand- |

|

|

|

|

|

|

| Mar 2017 | 38 | 40 | 12 | 9 | 1 | 0 | 31 |

| Feb 2017 | 36 | 39 | 17 | 6 | 2 | 0 | 33 |

| Jan 2017 | 34 | 43 | 16 | 6 | 1 | 0 | 31 |

| Dec 2016 | 39 | 37 | 16 | 6 | 1 | 1 | 33 |

Latest from Today's Medical Developments

- Auxilium Biotechnologies prints medical devices on the International Space Station

- KYOCERA SGS Precision Tools’ APEX Application Expert

- North American robotics market holds steady in 2024 amid sectoral variability

- Evident’s DSX2000 digital microscope

- Ferrocene becomes first Rust toolchain to achieve IEC 62304 qualification

- Germany expects a major decline in production in 2025

- Learn what you need to comply with CMMC requirements

- VersaBuilt’s CNC automation possibilities