AMT

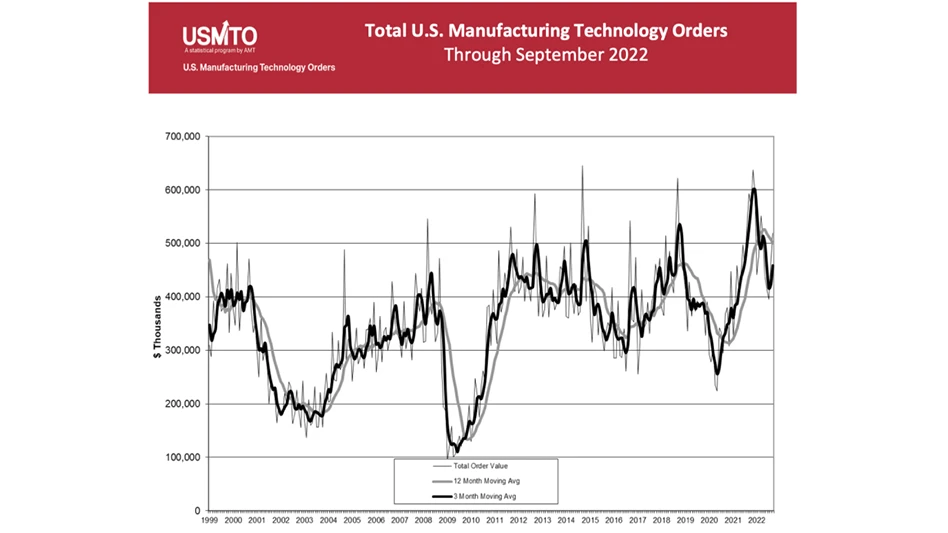

New orders of manufacturing technology totaled $519.3 million in September 2022, according to the latest U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology.

New orders of manufacturing technology totaled $519.3 million in September 2022, according to the latest U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology. September 2022 orders were up just under 13% from August 2022 but down 12.4% from September 2021, marking the first time an IMTS September had a lower order value than the year prior. Total orders in 2022 reached $4.2 billion, an increase of 2.7% over the first three quarters of 2021.

“We’re seeing the typical bump in orders brought on by IMTS and ‘the IMTS effect,’ but orders throughout 2022 are expected to fall short of 2021 order levels – the largest year in the program’s history,” says Pat McGibbon, chief knowledge officer at AMT. “The backlogs built over the last 18 months have lengthened delivery times and weigh on the decision to continue investing in additional equipment.”

Demand for additional domestic capacity and augmenting current production lines with automation has driven orders. In September 2022, that was particularly apparent in orders for forming and fabricating machinery. Appliance imports have fallen by nearly one-third but largely because of supply challenges, not a lack of demand. Appliance and HVAC manufacturers are increasing domestic capacity to bridge this gap, and that can be seen in the USMTO data. Supply chains for the aerospace sector are continuing to increase domestic capacity, particularly for cutting equipment, in an attempt to reduce reliance on foreign components. Likewise, manufacturers of agricultural equipment are continuing their investments in capital equipment. The agricultural sector has been feeling the brunt of recent labor shortages, which has necessitated the investment in more efficient, automated machinery. Additionally, with the growing unpredictability of Ukrainian grain exports, more reliance has been placed on expanded U.S. production.

Despite the anticipated slowing economy as 2022 closes and 2023 begins, the manufacturing sector remains humming at near-full capacity. “Quotations remain high, and anecdotally, we’re hearing that demand from our customer industries is not slowing,” McGibbon says. “While signs are positive now, we do expect orders to be softer the remainder of the year for most production equipment – with the exception of advanced and automation technologies. These technologies are in high demand to address the tighter labor market and increasing productivity of existing capacity. Also, continued efforts by North American manufacturers to increase their regional supply chain will continue to mitigate the modest decline in demand for durable goods. The softer order levels will provide the opportunity for manufacturing technology providers to convert their backlogs into shipped orders.”

Latest from Today's Medical Developments

- MedTech Innovator welcomes five new industry partners

- First Article Inspection for quality control

- The manufacturing resurgence is here – are you ready?

- Workholding solutions for your business

- ZOLLER events will showcase the company’s cutting-edge innovations

- THINBIT’s MINI GROOVE ‘N TURN Acme threading inserts

- CMMC Roll Out: When Do I Need to Comply? webinar

- Metabolic research uses Siemens gas analyzers to deliver results with 99.9999% resolutions