AMT

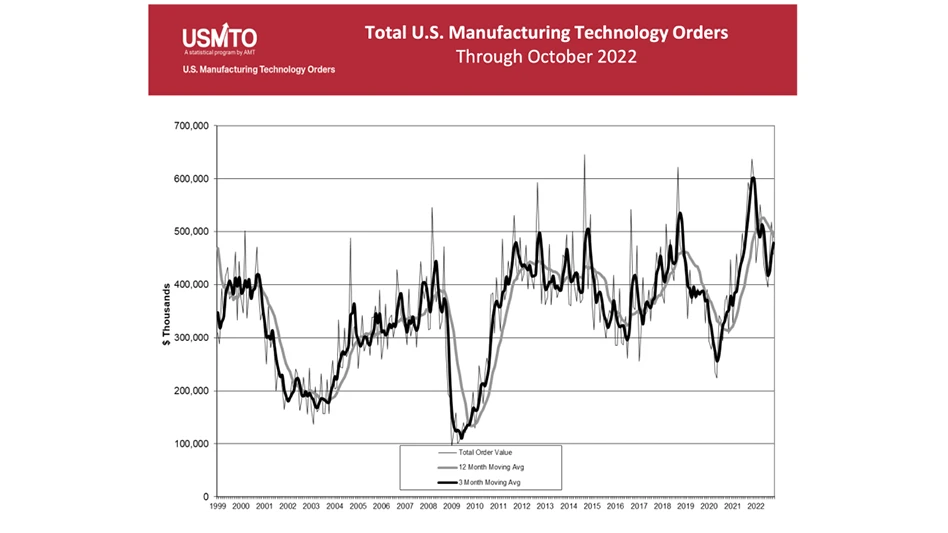

New orders of manufacturing technology totaled $457.7 million in October 2022, according to the latest U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology. October 2022 orders were 20% below October 2021 and 12% lower than September 2022, the smallest decline in orders from an IMTS September ever recorded. Orders are nearly even with this point in 2021, roughly $4 million above the YTD total in October 2021.

“Although we are reporting a down month and near-flat year-to-date sales, orders for manufacturing technology continue to come in at a near-record pace,” says Douglas K. Woods, president of AMT. “October 2022 was the third-highest October on record. Typically, orders in an October after an IMTS are down 23% from the previous month. Orders are returning to normal seasonal trends, but at an elevated level.”

Through most of 2020, all industries were reducing machinery orders, and in 2021, they seemed to be increasing orders in unison. However, for the last several months, customer industries returned to a more independent order pattern. For example, job shops are placing fewer orders for machinery as they return to their core customers such as aerospace and automotive. “While machinery orders from job shops are slowing, that trend could reverse if the economy tumbles into a mild recession,” Woods says. “In uncertain economic times, manufacturers tend to contract out any excess capacity needs instead of investing in additional machinery. This, in turn, leads job shops to require additional capacity of their own.”

Construction machinery manufacturers dramatically increased orders in October, likely in anticipation of government-funded infrastructure projects coming online. In line with infrastructure projects accounting for the increase in construction machinery, HVAC and appliance manufacturers decreased orders significantly in that same time. The decline in HVAC and appliances is likely the result of stalled new home construction projects as interest rates rise and development becomes more costly.

“While it will be difficult to match the amazing end to 2021, we are optimistic the orders through the remainder of 2022 will result in only a modest decrease from our best year on record,” Woods says. “The bonus depreciation passed in the 2017 Tax Cuts and Jobs Act will begin to sunset in 2023, likely accelerating orders that would have otherwise been placed in the following year. The impact of these additional orders may be offset by rising interest rates and slowing delivery times. Even anticipating a modest decline, it seems there is still steam behind this historic run of investment in manufacturing technology.”

Latest from Today's Medical Developments

- Arcline to sell Medical Manufacturing Technologies to Perimeter Solutions

- Decline in German machine tool orders bottoming out

- Analysis, trends, and forecasts for the future of additive manufacturing

- BlueForge Alliance Webinar Series Part III: Integrate Nationally, Catalyze Locally

- Robot orders accelerate in Q3

- Pro Shrink TubeChiller makes shrink-fit tool holding safer, easier

- Revolutionizing biocompatibility: The role of amnion in next-generation medical devices

- #56 Lunch + Learn Podcast with Techman Robot + AMET Inc.