AMT

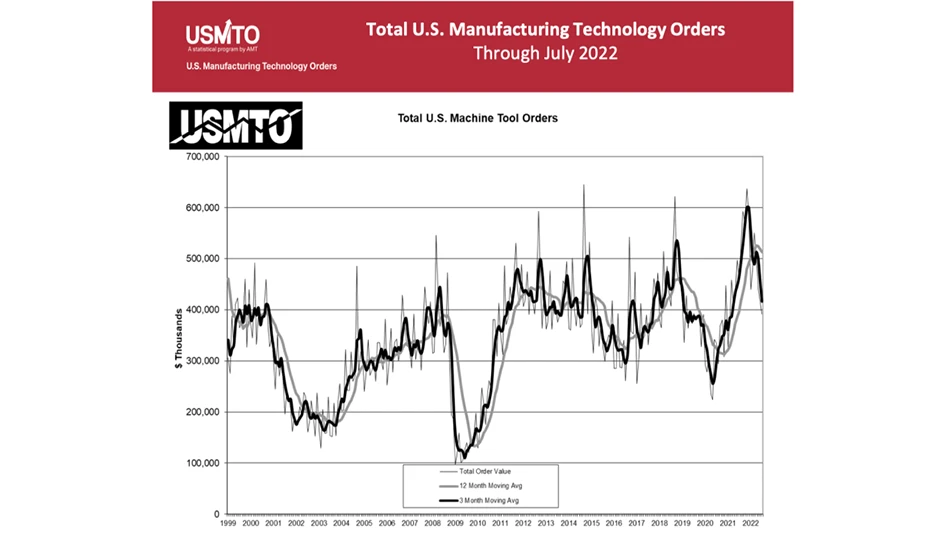

According to the latest U.S. Manufacturing Technology Orders report published by AMT – The Association For Manufacturing Technology, new orders of manufacturing technology totaled $291.9 million in July 2022. This was a decrease of 6.1% from June 2022 and were off 14.3% from July 2021. Manufacturing technology orders in 2022 have reached a total of $3.22 billion, an 8.7% increase over the first seven months of 2021.

“While July 2022 is down compared to July 2021, orders in both years were quite above what would be seen in a typical year,” says Douglas K. Woods, president of AMT. “Last year was the best on record and was particularly fueled by strong orders in the last third of the year, so it will be hard to match. However, given that orders are already nearly 9% over 2021, and with the typical boost to orders from IMTS, it appears possible to come close.”

The transportation sector, typically a driver of manufacturing technology orders, led the retreat into July. Orders placed by most motor vehicle manufacturing industries pulled back significantly in July after an outsized June order. Machine orders for railroad, ship, and other transportation manufacturing also decreased. The one bright spot in transportation was in aerospace, led by space and defense sectors, where orders nearly doubled from June to July 2021.

Manufacturing technology orders have benefited greatly from recent foreign direct investment, particularly in the manufacture of chips and batteries. “Not only has foreign direct investment in the United States benefited manufacturing in recent months, but the trend of reshoring has also greatly increased the need for additional capacity,” Woods says. “Metal valve manufacturers, whom we have highlighted in previous months, continue to place orders for machinery at levels that would be unheard of just a few years ago.

“The ongoing desire to create more resilient supply chains will continue to require more parts to be made domestically,” Woods says. “That demand has pushed manufacturing capacity utilization to an over two-decade high. If these trends continue, it could create a sustained need for additional manufacturing technologies – and particularly automation, should manufacturers continue to grapple with a shortage of labor.”

Latest from Today's Medical Developments

- Arcline to sell Medical Manufacturing Technologies to Perimeter Solutions

- Decline in German machine tool orders bottoming out

- Analysis, trends, and forecasts for the future of additive manufacturing

- BlueForge Alliance Webinar Series Part III: Integrate Nationally, Catalyze Locally

- Robot orders accelerate in Q3

- Pro Shrink TubeChiller makes shrink-fit tool holding safer, easier

- Revolutionizing biocompatibility: The role of amnion in next-generation medical devices

- #56 Lunch + Learn Podcast with Techman Robot + AMET Inc.