USCTI/AMT

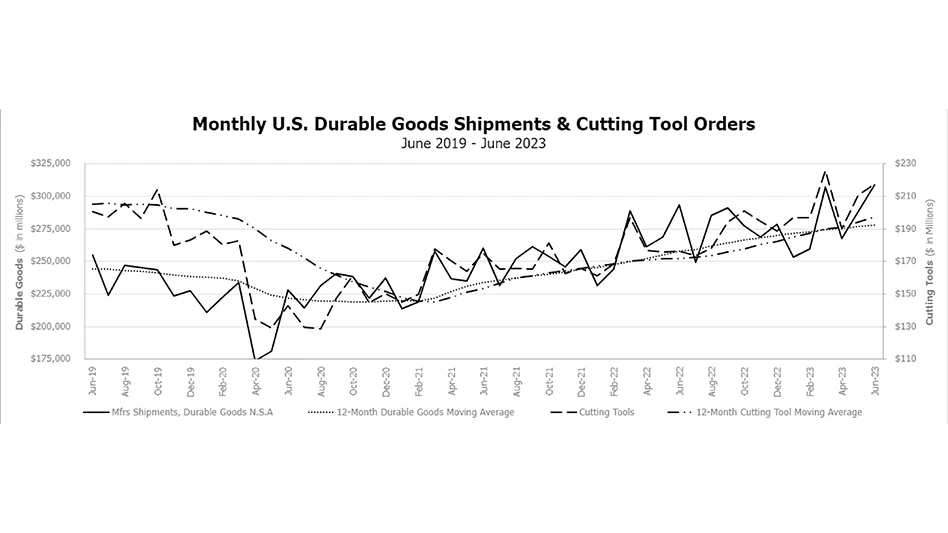

June 2023 U.S. cutting tool consumption totaled $217.3 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was up 3.2% from May’s $210.6 million and up 23.5% when compared with the $175.9 million reported for June 2022. With a year-to-date total of $1.24 billion, 2023 is up 17.4% when compared to the same time in 2022.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent most of the U.S. market for cutting tools.

“U.S. cutting tool orders continue to rise after rebounding from a soft April. Second quarter sales were strong versus 2022 sales for the same time period,” comments Jeff Major, president of USCTI. “Hiring pressures appear to have eased, which aids in the reduction in backlogs and drives business. There is optimism that the remainder of the year will remain positive.”

“The cutting tool industry continues to record strong sales growth compared to 2022,” states Bret Tayne, president of Everede Tool Co. “Much of this may be attributable to certain durable goods sectors, such as transportation and defense, that are core drivers of cutting tool consumption. If some of the critical customer categories are outperforming the overall economy, the cutting tool industry may enjoy better-than-anticipated growth.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

Latest from Today's Medical Developments

- MedTech Innovator welcomes five new industry partners

- First Article Inspection for quality control

- The manufacturing resurgence is here – are you ready?

- Workholding solutions for your business

- ZOLLER events will showcase the company’s cutting-edge innovations

- THINBIT’s MINI GROOVE ‘N TURN Acme threading inserts

- CMMC Roll Out: When Do I Need to Comply? webinar

- Metabolic research uses Siemens gas analyzers to deliver results with 99.9999% resolutions