CREDIT: TRENDFORCE

TrendForce reports that China, Japan, the US, South Korea, and Germany have consistently ranked among the top five countries for industrial robot installations and are expected to continue executing over $13 billion in related projects by 2025. The U.S. boasts a more advanced artificial intelligence (AI) ecosystem, while China is focused on building a robust supply chain. This divergence is expected to drive greater product pricing variations and application diversity in the future.

TrendForce notes that the U.S. government is primarily investing in smart robotics, autonomous systems, space robotics, and military robots. The humanoid robotics sector is led by companies such as Tesla and Boston Dynamics, with initial applications centered on manufacturing, warehousing, and logistics.

Technologically, US firms excel in AI training, including the development of the first vision-language action (VLA) model for high-frequency upper-body control in humanoid robots, the integration of Google Gemini 2.0 to enhance spatial awareness, and collaborations with NVIDIA to improve locomotion stability through reinforcement learning.

Leading U.S. semiconductor firms such as Qualcomm and NVIDIA offer end-to-end solutions with computing power exceeding 150 TOPS. Additionally, high-performance MCUs from Texas Instruments and Analog Devices further solidify the U.S.’s comprehensive AI-driven robotics ecosystem.

China, on the other hand, has identified robotics as a strategic priority in its 14th Five-Year Plan (2021–2025) and has issued various policy directives, including guidelines for innovation in humanoid robotics. The focus has been on developing a self-sufficient supply chain and key components.

Leading Chinese humanoid robot manufacturers include Unitree Robotics, Fourier, and UBTECH, while the “Movement Plane,” which accounts for approximately 55% of a robot’s total cost, has seen strong domestic investment. Chinese firms are actively developing coreless motors, 6D force-torque sensors, and harmonic drives, key components for humanoid robot mobility.

TrendForce points out that Tuopu Group, Sanhua Intelligent Controls, Hengli Hydraulic, Seenpin, and Zhaowei not only serve China’s domestic market but have also entered international supply chains or are undergoing testing with major global players. Furthermore, China is the world’s largest battery producer. As humanoid robots move toward mass production and require higher power efficiency, this advantage is expected to become increasingly critical.

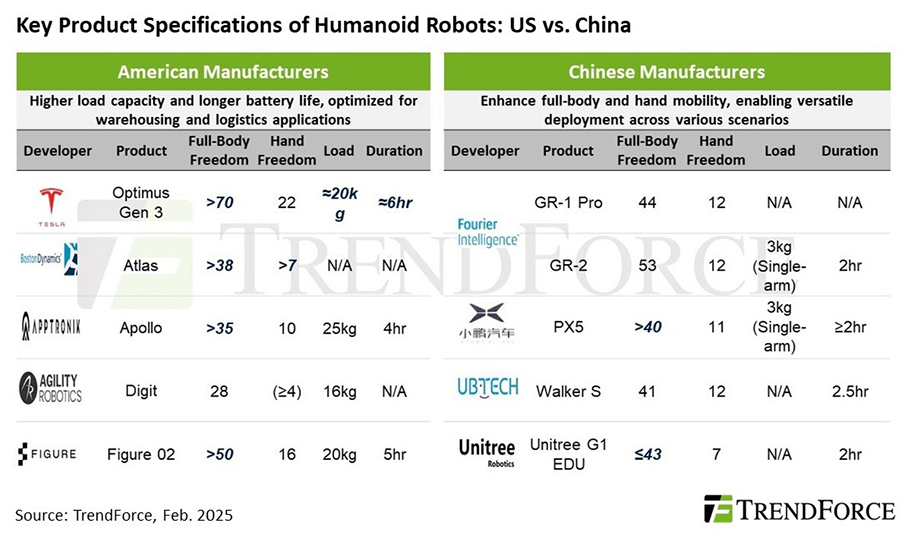

A comparison of core technological specifications of humanoid robots from the U.S. and China reveals that American companies focus on industrial applications, prioritizing payload capacity and battery life, while Chinese manufacturers emphasize versatility and greater degrees of freedom in full-body and hand movements. TrendForce highlights that, much like the current AI competition between high-capital and low-cost approaches, the humanoid robotics sector in the U.S. and China reflects their respective strengths.

Over the next five years, commercial humanoid robots are expected to exhibit significant price gaps and tiered applications, with regional ecosystems fostering localized production and industrial development.

Latest from Today's Medical Developments

- IMTS 2026 runs Sept. 14-19 at McCormick Place in Chicago, Illinois

- Master Bond’s MasterSil 800Med

- ZEISS celebrates 100 years of advancing innovation in the US

- Teleflex sells acute care and urology businesses for $2.03 billion

- HANNOVER MESSE: Where research and manufacturing meet

- What’s next for the design and manufacturing industry in 2026?

- Arcline to sell Medical Manufacturing Technologies to Perimeter Solutions

- Decline in German machine tool orders bottoming out