CREDIT: VDW

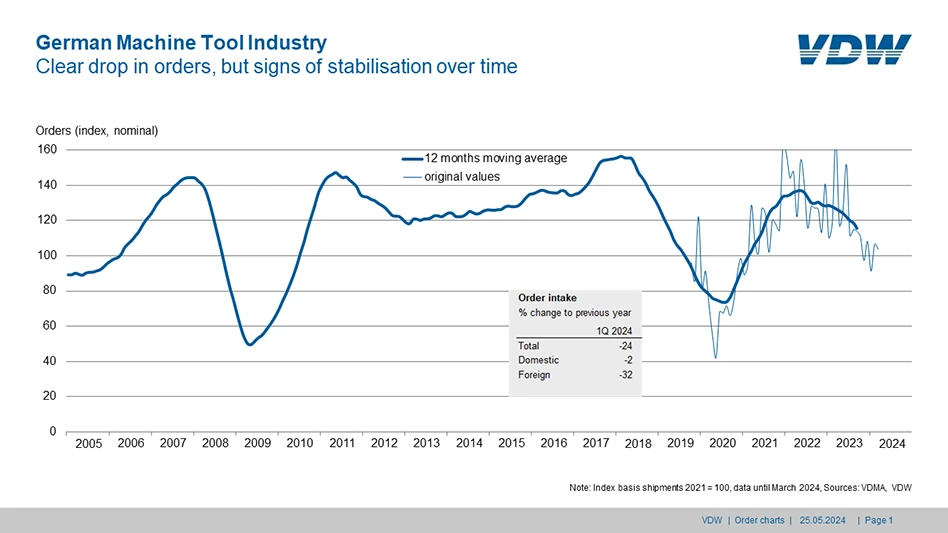

Orders received by the German machine tool industry in the first quarter of 2024 were 24% down on the same period last year. Orders from Germany fell by 2% whereas those from abroad dropped by a more considerable 32%.

"The sector is currently experiencing a major shortfall in orders compared to the previous year. This is due in part to a base effect, as there were still significant levels of orders on hand at the beginning of 2023," says Dr. Markus Heering, executive director of the VDW (German Machine Tool Builders' Association), Frankfurt am Main, commenting on the result. The first signs of stabilization are currently emerging, although the coming months will prove decisive here.

"Our members are telling us that there is clear demand from customers in Germany, too, but that many investment decisions are currently being put on hold due to the high level of uncertainty," Heering continues.

Some indicators suggest that the situation could improve in the second half of the year. Lower inflation, reduced energy prices, the prospect of the first interest rate hikes, the end of destocking, improved economic indicators and higher real incomes which boost consumption could provide a basis for a return to higher investment.

This analysis is also supported by the turnaround in the Global Purchasing Managers' Index, which returned to low-level growth at the beginning of the year.

For 2025, Oxford Economics, the VDW's forecasting partner, predicts a strong increase of 8.3 percent in global machine tool consumption. In regional terms, the upturn is broad-based. India, the ASEAN region, the US, Mexico and Canada in particular are emerging as driving forces. A return to a clear upward trend can be expected in many European countries.

"Rising international consumption could well feed through to an increase in orders in Germany," says Heering confidently. "What is crucial now in this country is for the inquiries to translate into actual orders."

Heering also points out how the government has a role to play here by ensuring that industry can look to the future with greater confidence.

Latest from Today's Medical Developments

- Best of 2024: #8 Article – Perfecting the CMP process for surgical blades

- Best of 2024: #8 News – Johnson & Johnson to acquire Shockwave Medical

- Best of 2024: #9 Article – Strategy Milling combines old and new for precision dental restorations

- Best of 2024: #9 News – Global robotics race

- Best of 2024: #10 Article – Designing medical devices for every user

- Best of 2024: #10 News – 4 predictions for 2024: AI set to supercharge robotic automation

- Children’s National, FDA collaborate to advance pediatric device regulatory tools

- LK Metrology’s eco-friendliness CMMs