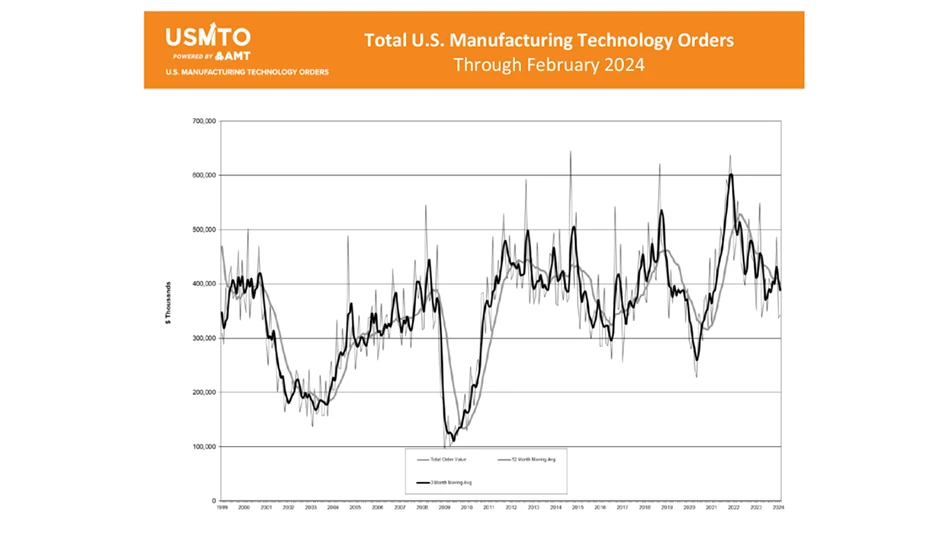

CREDIT: AMT

Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, totaled $343.3 million in February 2024. This was a 2.1% increase from January 2024 but a 26.5% decline from February 2023. Year-to-date orders reached $679.6 million, a decline of 16.9% from the first two months of 2023.

While orders have thus far fallen short of the expectations from the beginning of the year, it is important to remember how good orders were in the first quarter of 2023. Manufacturing technology orders in the first three months of 2023 averaged $455.6 million per month. In the remainder of the year, monthly orders only reached $395.9 million. This is high by historical standards but reachable given the resilient economy and IMTS returning to Chicago’s McCormick Place later in the year. Small and medium sized businesses, primarily contract machine shops, continued to fall behind the market, yet OEMs in several sectors increased their capital investment.

Contract machine shops, the largest consumer of manufacturing technology, continued to decrease their orders. While they have generally ordered less relative to the overall market in recent months, this is only the second time since September 2021 that job shops decreased machinery orders while the overall market was expanding.

Manufacturers of engines, turbines, and power transmission equipment increased orders to the highest level since February 2023. Orders from this sector have been elevated in recent years due partly to extreme weather requiring infrastructure improvements to improve grid reliability as well as government incentives around clean energy generation. The last time orders were at these levels was between late 2007 and the summer of 2008 when natural gas plants started becoming the dominant source of energy generation in the United States.

The aerospace industry posted the second-largest order volume since December 2022, only surpassed by December 2023. While commercial aviation is a large part of the sector, there will be several large opportunities in the defense side of the business throughout the year. The Pentagon recently announced funding for new programs to improve the F-35 Joint Strike Fighter and both Lockheed and Boeing were recently awarded contracts to develop or supply missile systems.

March is the end of the fiscal year for several companies, so in most years, orders tend to increase. With an order value of $548.8 million in March 2023, it will be difficult to surpass if demand from contract machine shops continues to fall behind the overall market. Even if orders fall short of 2023 levels next month, there are positive signs the remainder of 2024 will provide some opportunities for growth.

The March 2024 ISM® Manufacturing PMI® showed the manufacturing sector was expanding for the first time since September 2022. If new orders and production continue to improve, orders of manufacturing technology will surely increase as OEMs begin to give work to contract machine shops to keep pace with their customers’ demands. Given the typical lag between increased demand and new machinery orders, shops may begin to need additional capacity just in time to ‘kick the wheels’ at IMTS 2024.

Latest from Today's Medical Developments

- The toolbelt generation

- Covestro's role in transforming cardiac care

- Practical and Affordable Factory Digital Twins for SMEs

- UCIMU: fourth quarter 2024 machine tool orders on the rise

- Thomson Industries’ enhanced configuration capabilities

- Frequently Asked Questions about AM Post Processing

- How new executive orders may affect US FDA medical device operations

- Midwest DISCOVER MORE WITH MAZAK