AMT - The Association For Manufacturing Technology

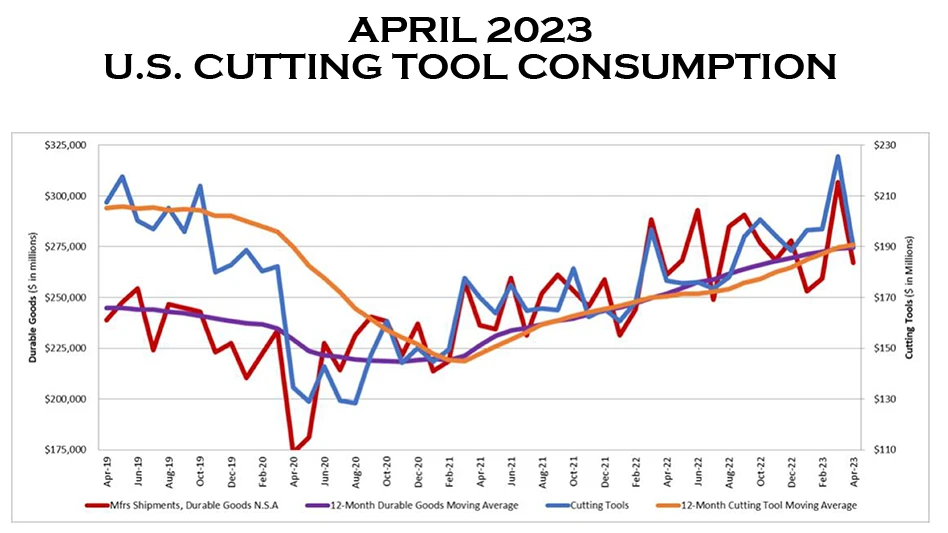

April 2023 U.S. cutting tool consumption totaled $190.0 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 15.8% from March’s $225.6 million and up 7.5% when compared with the $176.7 million reported for April 2022. With a year-to-date total of $809.0 million, 2023 is up 15.2% when compared to the same time period in 2022.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

“While several industry market segments have contracted recently, cutting tool market indicators remain positive with anticipated mid-single digit growth for 2023,” comments Jeff Major, president of USCTI. “There is a consensus that cutting tool inventories are higher within the distribution segment, which may indicate a short-term inventory burn followed by a possible uptick in renewed buying.”

“After a spike in the first quarter of 2023, April shipments of cutting tools fell back to the levels seen at the start of this year, still remaining 7.5% above the April 2022 performance,” says Mark Killion, director of U.S. industries at Oxford Economics. He expanded on this, saying, “Demand from durable goods manufacturers has supported shipments over the past year but is now expected to turn weaker in coming months, in line with expectations for a shallow recession.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.

Latest from Today's Medical Developments

- Arcline to sell Medical Manufacturing Technologies to Perimeter Solutions

- Decline in German machine tool orders bottoming out

- Analysis, trends, and forecasts for the future of additive manufacturing

- BlueForge Alliance Webinar Series Part III: Integrate Nationally, Catalyze Locally

- Robot orders accelerate in Q3

- Pro Shrink TubeChiller makes shrink-fit tool holding safer, easier

- Revolutionizing biocompatibility: The role of amnion in next-generation medical devices

- #56 Lunch + Learn Podcast with Techman Robot + AMET Inc.