CREDIT: AMT

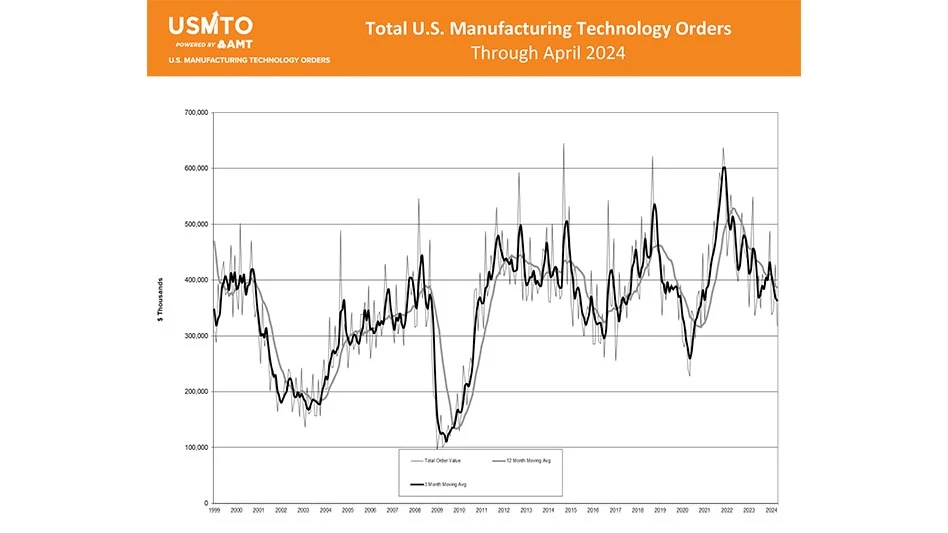

Orders of manufacturing technology, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, reached $317.9 million in April 2024. This is a 25.6% decrease from March 2024 but only 5.4% behind orders in April 2023. Orders in 2024 totaled $1.43 billion through April, 16.2% behind orders placed in the first four months of 2023.

Machinery orders have been steadily declining since hitting a peak in the fourth quarter of 2021, according to the USMTO data. Although 2024 has had the weakest start to the year since 2020, orders through April are nearly 5% above the average order volume through the first four months of a year since USMTO began tracking orders in 1998.

Contract machine shops, the largest customer of manufacturing technology, decreased orders significantly in April compared to March 2024 – but by less than the overall market. Still, contract machine shops experienced the slowest start to the year since the first few months of 2020, when COVID shutdowns caused orders to crater.

After two strong years of orders, the automotive industry has begun to pare back investment in manufacturing technology. Consumer demand for electric vehicles has not met expectations despite significant investment from major automakers. Additionally, demand for internal combustion engines has lagged behind expectations as inflation persists and heightened interest rates give pause to consumers looking to purchase and finance a new vehicle.

The aerospace industry has continued its elevated level of investment into 2024. Order activity from this sector is particularly strong in the Southeast region, leading it to the strongest growth of any region. Driven by a pool of talented workers, aerospace companies have been opening and expanding manufacturing operations in the Southeast over the last several years, particularly in North Carolina.

In the longer-term trend, the decline in orders appears to be stabilizing. At AMT’s Spring Economic Webinar, Oxford Economics revised their forecast to predict 2024 will end flat or slightly down compared to 2023, anticipating a pickup in order activity through the remainder of the year. Through April, new orders of durable goods were nearly flat compared to the beginning of 2023, and industrial production fell 7.6% from its post-COVID peak. Oxford Economics further predicted that industrial production had reached its lowest point of the current business cycle in most advanced economies.

On average, orders in the second half of a year exceed the first by nearly 10%. Should industrial production and new orders pick up through the remainder of 2024, manufacturers will begin to need additional capacity right around the time the doors to IMTS 2024 open in Chicago.

Latest from Today's Medical Developments

- Best of 2024: #5 Article – Accelerating medical device development with freeform injection molding

- Best of 2024: #5 News – Complexity, the enduring enemy of medical cybersecurity

- Best of 2024: #6 Article – Closing the global product information gap

- Best of 2024: #6 News – NUBURU enters medical device market with order Blueacre Technology

- Season's greetings

- Best of 2024: #7 Article – Synchronized machining processes for medtech

- Best of 2024: #7 News – 3D printing could revolutionize treatment for cataracts, other eye conditions

- Best of 2024: #8 Article – Perfecting the CMP process for surgical blades