The Cutting Tool Market Report

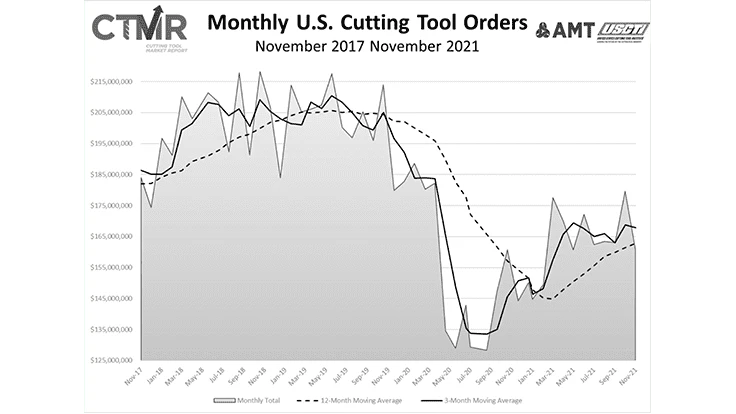

November 2021 U.S. cutting tool consumption totaled $160.7 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This was down 10.5% from October's $179.6 million and up 11.4% when compared with the $144.3 million reported for November 2020. With a year-to-date total of $1.8 billion, 2021 is up 8.2% when compared to the same period in 2020.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent most of the U.S. market for cutting tools. Cutting tool orders have been on an upward trend since hitting the bottom in August 2020 but has not seen a consistent month-to month rise.

“The uncertainty continues in our market as indicated by the data: one month increase and then one month decrease for the last six months,” said Brad Lawton, chairman of AMT’s Cutting Tool Product Group.

“The industry is clawing its way back to pre-pandemic activity, but it is not on a linear path, as each month brings new challenges,” Tom Haag, president at Kyocera SGS Precision Tool. “How will the Omicron variant affect industrial productivity? When will the microchip shortage in automotive production end?”

Despite concern over monthly fluctuations, the overall sentiment remains positive on the trajectory of the industry into 2022.

“We are optimistic that 2022 will continue that progress in the industry, but full recovery is still in the distance,” continues Haag.

Forecasting the industry would find a way around the present obstacles to growth, Lawton concludes, “We have been on these choppy waters before, and we will continue to make our way.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process, the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.

Latest from Today's Medical Developments

- MedTech Innovator welcomes five new industry partners

- First Article Inspection for quality control

- The manufacturing resurgence is here – are you ready?

- Workholding solutions for your business

- ZOLLER events will showcase the company’s cutting-edge innovations

- THINBIT’s MINI GROOVE ‘N TURN Acme threading inserts

- CMMC Roll Out: When Do I Need to Comply? webinar

- Metabolic research uses Siemens gas analyzers to deliver results with 99.9999% resolutions