Association for Advancing Automation (A3)

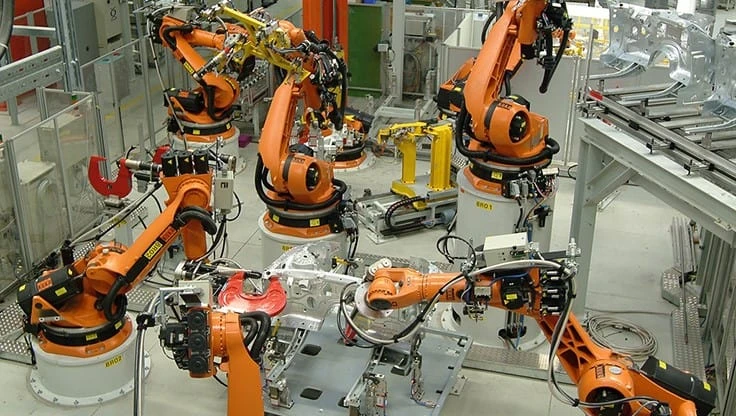

Strong robot sales in the third quarter of 2021 bring the total number of orders so far this year to nearly 29,000 units valued at $1.48 billion, the best numbers ever recorded for the North American robotics market. According to the Association for Advancing Automation (A3), these numbers show increases of 37% in units sold (up from 21,072) and 35% in value (up from $1.09 billion) over the same period in 2020 and surpass the previous highest record from 2017 by 5.8% and 0.5%.

In Q3 alone, North American companies ordered 9,928 robots valued at $513 million, up 32% and 35% respectively over the third quarter of 2020. This marks the third highest quarter ever in units ordered and fifth highest in value.

“With labor shortages throughout manufacturing, logistics and virtually every industry, companies of all sizes are increasingly turning to robotics and automation to stay productive and competitive,” says Jeff Burnstein, president of A3. “As our latest statistics indicate, sales are on track to make 2021 the biggest year ever for robotics orders in North America. We see many current users expanding their applications of robotics and automation throughout their facilities while first time robotics users are emerging in a wide range of industries such as automotive, agriculture, construction, electronics, food processing, life sciences, metalworking, warehousing and more.”

www.automate.org/news/q3-robot-orders-put-2021-on-track-for-biggest-year-yet

2021 showcases strong climb for non-automotive robotic sales

In the first nine months of 2021, automotive-related orders increased 20% year over year to 12,544 units ordered. Non-automotive orders outpaced this growth, expanding 53% to 16,355 units ordered, marking only the second time non-automotive orders have surpassed automotive-related orders in the first nine months of a year (2020).

In Q3 2021 specifically, nearly two-thirds of sales (6,302) came from non-automotive industries, further demonstrating the trend of robotics growing into areas outside of automotive OEM and tier suppliers. Unit sales from non-automotive industries in Q3 saw the following increases over the same quarter in 2020:

- Metals: 183%

- Food and Consumer Goods: 40%

- Semi and Electronics/Photonics: 26%

- Plastics and Rubber: 10%

- All Other Industries: 97%

Manufacturer and A3 member 3M has experienced the trends firsthand. "3M is seeing an upswing in providing automated solutions and processes for our customers, but as a manufacturer ourselves, we are also increasingly investing in automation,” saysCarl Doeksen, global robotics/automation director, 3M’s Abrasive Systems Division. “The pandemic put a spotlight on the benefits that automated processes bring – from the ability to ramp-up and scale-up production quickly and efficiently, to helping improve the lives of our employees, our customers, and their families.”

Latest from Today's Medical Developments

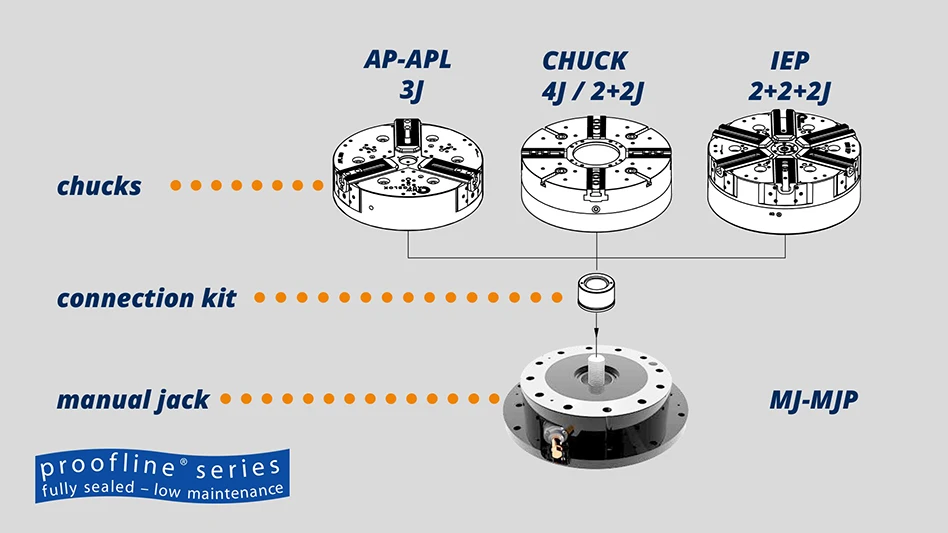

- Workholding Roundtable with SCHUNK, EMUGE FRANKEN USA, and SMW Autoblok

- Canadian company wins ROBOTICS AWARD 2025

- XP Power’s CCR AC-DC power supplies

- Quality Control of Surfaces in the Digital Age

- High precision, productivity in combined punching and shearing systems

- GROB G550T 5-axis mill-turn universal machining center

- Betacom, Siemens launch 5G network platform to accelerate manufacturing innovation

- Starrett’s AVR400 CNC vision system