USCTI/AMT

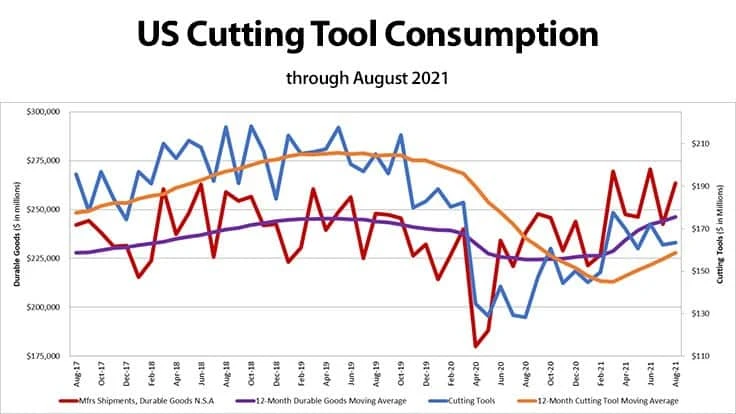

July 2021 U.S. cutting tool consumption totaled $162.3 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 5.7% from June's $172.1 million and up 25.5% when compared with the $129.4 million reported for July 2020. With a year-to-date total of $1.1 billion, 2021 is up 4.6% when compared to July 2020.

According to Brad Lawton, chairman of AMT’s Cutting Tool Product Group, “The cutting tool industry continues to show year-over-year positive growth for 2021 from the low of the pandemic year. However, the last few months have slowed for many reasons and have produced an up-and-down performance because of disruptions to the normal business conditions. Supply chain shortages, labor shortages, inflation, weather disruptions, and of course, the continuing COVID effects have all played a part in the roller-coaster ride, but in the end, the manufacturing industry shows the demand for growth, and the cutting tool industry is poised to respond.”

Chris Kaiser, executive advisor of Big Kaiser, comments, “July’s cutting tool report slipped to the negative compared to the previous month, probably due to supply chain disruptions and summer vacations. On the positive side, the 12-month average follows durable goods, which is increasing slowly and may get to pre-pandemic levels by the end of Q1 2022. If cutting tool consumption follows the machinery order trend, which it normally does with a two to five-month lag time, we should see better numbers by year-end and a good start to 2022.”

August 2021 U.S. cutting tool consumption totaled $163.5 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was up 0.7% from July's $162.3 million and up 27.4% when compared with the $128.3 million reported for August 2020. With a year-to-date total of $1.3 billion, 2021 is up 7% when compared to the same time period in 2020.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

Bret Tayne, president of USCTI, notes, “Although year-over-year growth in the cutting tool sector for April through August has been robust, we remain well below 2019 levels. Our growth path remains uneven, and steadier improvement is frustrated by policy and other factors. That said, colleagues, supply chain partners, and end-user customers that I have spoken to recently seem to be universally confident in the near term.”

Pat McGibbon, chief knowledge officer of AMT, comments, “We think the outlook for cutting tools is bright. Cutting tool shipments' year-over-year moving average has been 24% over the past four months, and machine tool orders are up 48% year-to-date from 2020 levels. We see the severe difference in growth rates between consumables and equipment as a reflection of the challenge downstream customers are having in securing materials and parts to machines. It is just a matter of time before these bottlenecks break loose.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Latest from Today's Medical Developments

- MedTech Innovator welcomes five new industry partners

- First Article Inspection for quality control

- The manufacturing resurgence is here – are you ready?

- Workholding solutions for your business

- ZOLLER events will showcase the company’s cutting-edge innovations

- THINBIT’s MINI GROOVE ‘N TURN Acme threading inserts

- CMMC Roll Out: When Do I Need to Comply? webinar

- Metabolic research uses Siemens gas analyzers to deliver results with 99.9999% resolutions