Pebax polymer is a thermoplastic elastomer manufactured by Arkema, which istubing applications. Pebax polymer is a thermoplastic elastomer manufactured by Arkema, which istubing applications. |

Regulation of surgical devices in the United States is by the FDA, and materials of construction are often an integral part of the regulatory submission process. Changing such materials can be costly and time consuming. Accordingly, medical device manufacturers are highly attentive to ensuring ongoing supply of key materials once devices meet regulatory filing requirements and sell commercially. Commonly used to manage supply risks are contractual agreements between material suppliers and manufacturers.

Material supply agreements for medical devices include detailed requirements related to material specifications, quality requirements, packaging, pricing, logistics, and volumes. Force majeure clauses in supply agreements free the parties from certain contractual obligations in the occurrence of an extraordinary event beyond the control of one or both parties. Such events may include but are not limited to wars, strikes, riots, and ‘Acts of God’ such as hurricanes and floods. When such events occur, suppliers may publicly announce ‘force majeure’ to inform contractual customers of the event. This allows better management of supplies, by the supplier, to all customers without binding requirements of any single customer.

An announcement of force majeure does not necessarily mean there will be no supplies available. Often an extraordinary event may constrain a supplier. The relatively small consumption of many polymers in medical devices compared to other markets, such as automotive, can provide opportunities to manage material challenges during supply constraints. Medical device components are often small and frequently produced only in the tens or hundreds of thousands of units per device. Polymer usage for such devices is typically in the hundreds of pounds rather than millions of pounds. Carefully planned stock management and allocation strategies by polymer manufacturers and distributors can often sustain device companies for reasonable periods during such crisis.

The most current example of this occurred with the recent tragic explosion at an Evonik plant in Marl, Germany. This plant produced CDT (cyclododecatriene), used to manufacture laurolactam monomer, a major component for polyamide 12 production. Evonik was a significant supplier of CDT to the global polymer market. Their disrupted production has resulted in constraints in the manufacture of polyamide 12 and related polymers, including Pebax* polyether block amide.

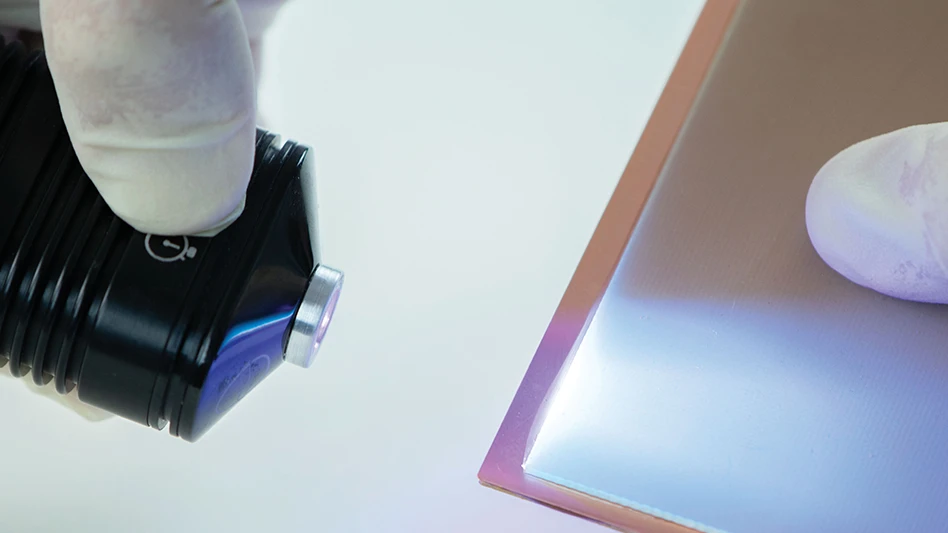

Pebax polymer is a thermoplastic elastomer manufactured by Arkema for use in catheter tubing applications, such as percutaneous transluminal coronary angioplasty (PTCA) devices. These are the devices used for balloon angioplasty and stent delivery to open clogged arteries around the heart. The product also finds use in automotive fuel hoses and athletic footwear applications. Basis for a portion of the chemical formulation of Pebax grades is on CDT chemistry.

Pebax polymer, manufactured by Arkema Inc., is distributed by Foster Corp. to users of the material in the medical market. Pebax polymer, manufactured by Arkema Inc., is distributed by Foster Corp. to users of the material in the medical market. |

Because of the event at the Evonik plant, Arkema formally announced that they were no longer able to comply with their commitments of delivery to all markets for Pebax polymers and, on April 16, 2012, declared force majeure for an undetermined period of time during which there would be a suspension of contractual obligations. Since Pebax polymer finds common use in many regulated catheters, this announcement caused concern amongst device manufacturers.

Several factors have diffused the initial wave of concern. First, while Evonik is a major supplier of CDT, they are not the only source. CDT is still available, albeit in short supply, and Pebax polymer is still in production, albeit within limits.

Second, Pebax polymer is a copolymer made of a rigid polyamide segment and a flexible segment. Only the polyamide rigid portion uses CDT chemistry allowing for a greater amount of Pebax polymer manufacturing with a given amount of CDT, in comparison to polyamide 12. This extends the amount of material that can be produced.

Third, the medical market requires lesser amounts of Pebax polymer than other markets due to the small sized, specialized applications. Catheters are very thin wall tubes and modest amounts of the material can make a significant amount of catheters.

Foster Corporation, the official distributor of Pebax polymer to the North American medical market, has been able to work directly with device manufacturers and processors to ensure ongoing supply for existing applications using allocation strategies based on historical monthly requirements.

Since a force majeure announcement is a legal matter related to contracts, it would be unlikely for companies such as Arkema or Evonik to lift a force majeure until they are able to supply all contractual obligations to their fullest. This does not mean that the restricted supply situation remains unchanged until the force majeure lifts. In the case above, Evonik has indicated repairs to the facility are proceeding and will take several months or more to complete. At the same time, Arkema may pursue alternative sources of CDT to manufacture Pebax polymer. These activities could yield steadily improving supply during the next several months, well before a force majeure may official lift. During this period, existing inventories of the polymer and feedstocks available to manufacture additional polymer (i.e. CDT) appear to be sufficient to sustain the limited volume demand by the medical device market.

Medical device manufacturers are increasingly using specialized polymers that offer unique performance properties. Production of performance polymers is often by just a few suppliers, with the chemicals required to make such polymers manufactured by only a few suppliers. Often, the value of these polymers in cutting edge devices outweighs the supply risk associated with having only a few sources. Fortunately, the amount of polymer required to satisfy the needs of medical device manufacturers is relatively low in comparison to other markets. Polymer producers and distributors may have sufficient supplies to sustain short-term supply disruptions from catastrophic events. Contrary to strategies to maximize cash by decreasing inventory, device manufacturers may also consider additional stock levels of specialized polymers to buffer such events given the expiration date of most materials, including Pebax polymer, is multiple years.

Foster Corp.

Putnam, CT

fostercomp.com

*Pebax is a registered trademark of Arkema Inc.

Explore the July 2012 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- Copper nanoparticles could reduce infection risk of implanted medical device

- Renishaw's TEMPUS technology, RenAM 500 metal AM system

- #52 - Manufacturing Matters - Fall 2024 Aerospace Industry Outlook with Richard Aboulafia

- Tariffs threaten small business growth, increase costs across industries

- Feed your brain on your lunch break at our upcoming Lunch + Learn!

- Robotics action plan for Europe

- Maximize your First Article Inspection efficiency and accuracy

- UPM Additive rebrands to UPM Advanced