Shown is a hip forging, as produced at the Zimmer plant in Winterthur, Switzerland.When you think of stylish and elegant designs of timepieces, Swiss watches likely come to mind – as products of the highest quality and craftsmanship. However, for a short time in the history of the watch-making industry, Swiss watches suffered some setbacks.

Shown is a hip forging, as produced at the Zimmer plant in Winterthur, Switzerland.When you think of stylish and elegant designs of timepieces, Swiss watches likely come to mind – as products of the highest quality and craftsmanship. However, for a short time in the history of the watch-making industry, Swiss watches suffered some setbacks.

For several centuries, Switzerland was the world leader in the manufacture of clocks and watches. Up to the 1970s, Swiss watches controlled more than half of the world watch market. The watch making industry produced an employment of around 10% of the industrial labor force in the country. In addition, Swiss watches contributed at least 10% percent of the countries’ total export.

However, dominance of Swiss watches in the world was shaken due to the introduction of inexpensive quartz watches from Japan. A quarter of Switzerland’s watch-making companies collapsed, taking years before Swiss watches recovered – with production of low-price, high quality analogue Swiss watches from Swatch.

Beyond the watch comeback was the strong initiative to apply precision manufacturing knowledge to other fields, and the medical device industry was the answer.

Swiss Facts

Did you know that U.S. foreign investment in Switzerland accounts for 40% of all foreign investment, while Switzerland is the seventh largest investor in the United States? In addition, there are nearly 680 North American companies in Switzerland that employ 58,000 people.

The Swiss medical technology industry consists of nearly 740 suppliers and manufacturers, and approximately 650 traders, distributors, and service providers. As one of the fastest growing sectors, the Swiss medical technology industry expected growth rate is 12% for 2011, which, according to the Swiss Medical Cluster’s report (medical-cluster.ch) for 2010, is significantly above the expected Swiss gross domestic product growth rate of 1.9%.

In addition, Switzerland is a heavy exporter of medical technology, with the average rate of export being 63%, with manufacturers exporting 78% of products and suppliers exporting 53% of products. The Swiss Medical Cluster’s report also shows that export-oriented manufacturers expecte a growth rate of 18% for 2010.

Throughout the country, there is a range of regional economic development agencies working closely with companies to ensure continued growth within the medical device industry. One such example is the Basel Area Business Development group (baselarea.ch), which is one of the world’s most successful life science clusters, represented by companies from medical technology and diagnostics to biotechnology and pharmaceuticals.

Extending beyond the various government- and canton-backed agencies is traditional collaboration between university institutions and businesses, which further enables market growth. Bio Alps (bioalps.org) is a major European center for biotech research and is home to more than 200 bio- and medical technology companies, more than 500 research laboratories, and more than 10 research institutions.

On a recent trip to Switzerland, a group of journalists were able to get a close up look at what medical device industries are thriving in the country, and why.

Medical Technology

As an international hub for many well-recognizable medical technology companies – J&J Medical, Zimmer, Medtronic, B. Braun, Stryker, and Synthes – the list of companies that may not be household names but are large medical device industry players is just as impressive. They are companies such as Straumann, Jossi Orthopedic, Medela, Medartis, Bien Air, Mikron, and FKG Dentaire. The group of journalists attended a range of factory visits, getting an inside look at the Swiss medical manufacturing sector.

Straumann AG (straumann.com) began as a research institute specializing in materials testing and alloys for use in timepieces. One of their inventions was an alloy that is still used in watch spring technology today. Then, a breakthrough in the use of non-corroding alloys in fracture repairs inspired the company to move into the area of orthopedics and implantology. As time and buyouts occurred, the founder’s grandson, Thomas Straumann, began to focus the company’s entire energies on dental implants – as the current industry leader.

“The 1980s saw Straumann pioneering the use of titanium dental implants to replace the natural tooth root and act as a reliable, lasting anchor for replacement teeth. This has become the standard of care, and Straumann is the second largest manufacturer of implants with a market share of 17% and a global workforce of more than 2,100 people,” says Mark Hill, head of corporate communications.

Continued investment in their materials sciences – including additions to their implant, prosthetics, and regenerative product ranges – enables Straumann to be a full service provider in the dental industry.

If dental implants are necessary, then the proper tools to help with the implant must also be the best. Bien-Air Medical Technologies (bienair.com) delivers air-driven tools used in dental, as well as ear, nose, and throat surgeries, but it is their air-driven turbines that are used for dental implants. Today, Bien-Air covers the full dental technology value chain – from prophylaxis to prosthetic restoration – and has extended its product range to include electrical micro-motor systems and is a leader in that industry as well.

An additional aspect of the dental industry is the need for tooling for endodontic work – the treatment of the dental roots. Originally founded in 1931, FKG Dentaire (fkg.ch) took a decisive step in 1996 after research showed that manufacturing instruments out of nickel-titanium would offer greater flexibility and elasticity qualities. Results of this move forward was a tool that offers the cutting efficiency required for precise dental drilling of root canals while avoiding the oft-occurring tool tip breakage within the tooth.

“A nickel-titanium coating is applied to the instruments, using a proprietary electrochemical treatment, that improves the surface quality, in turn increasing the tools resistance to working torsion and cyclical fatigue,” explains Jean-Claude Rouiller, who took ownership of the company in 1994. With the great success in improving the approach to root canals, FKG Dentaire produces nearly 15 million parts per year, exported around the world.

Orthopedics

Jossi Holding AG (jossi.ch) management considers their company a full-service solution provider. Made up of Jossi Ltd., Jossi Orthopedics Ltd., and Jossi Systems Ltd., the company staff delivers precision engineering and manufacturing as both a contract manufacturer and an orthopedics manufacturer.

What began in 1957 was a precision manufacturing company founded by Hans Jossi. Originally working in the manufacturing of components for the nuclear industry, medical did not enter until 1977. Beginning with work in the orthopedics field ultimately led to pioneering manufacturing processes that continue today. “Known as Hybrid Manufacturing, Jossi Orthopedics’ trademarked process, this approach combines forming and machining with minimal material waste for a range of implants. Today, Jossi Orthopedics’ customers sell their products – joints, spine, trauma, and instruments – throughout the world,” explains Dr. Martin Schmidt, Jossi Orthopedics, international markets.

As the contract manufacturing part of the company, Jossi delivers the full range of services within the medical, laboratory, automation, and semiconductor assembly fields.

Jossi Systems functions in process production in textile manufacturing with a worldwide of all major cotton producing countries.

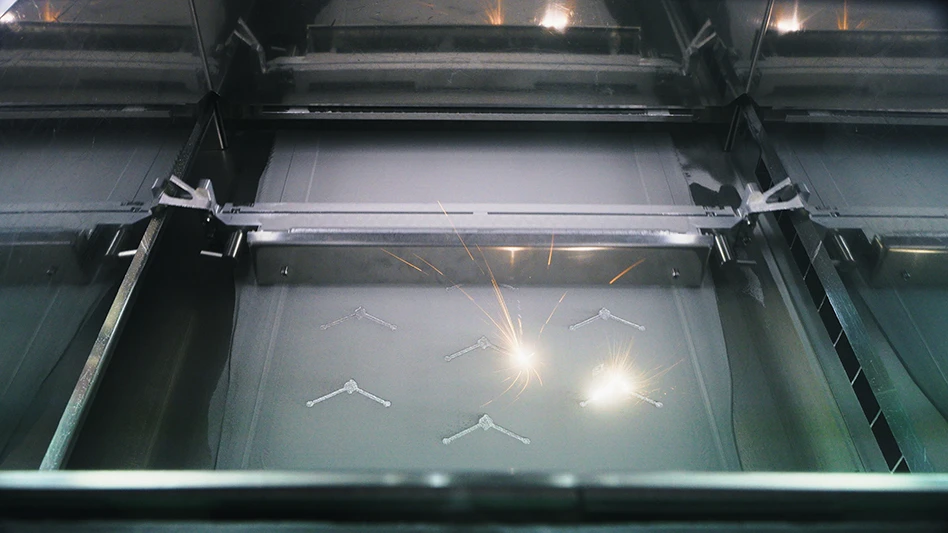

Zimmer (zimmer.com) addresses the needs in the musculoskeletal market. Components produced in the Winterthur, Switzerland, facility include hip stems, knee systems, spine implants, trauma implants, and upper extremities – while also including a large R&D facility. In a $30 billion market, Zimmer holds a 27% market share for knee systems, 21% market share regarding hip systems, 13% market share for extremities – such as rods and pins, 6% market share in dental, 5% trauma market share, and 3% market share in spinal. Overall, this puts Zimmer at the number one ranking of market share in the global reconstructive market – due to its broad range of pre-implant, implant, and bone-conserving procedures.

Training

Beyond the medical manufacturing that is as precise as the Swiss watch making industry is the training – schooling, apprenticeships, and continuing education. Typical apprenticeships last between two and four years and is a cost to a manufacturing company, but one that returns highly skilled workers in a field that needs precision handed down from one generation to the next.

For example, during the medical technology visit, most of the facilities we visited had apprentices in the facility, and their apprenticeships consist of a split week of work in the manufacturing facility and classroom studies back at their school. Each company can develop their own offerings in an apprenticeship, but the length is determined through the academia setting – Swiss students get the opportunity to enter the business world through apprenticeships of their interest after completing their required school years. After an apprenticeship, individuals can return to additional academia at the university level of either a Canton-run or a Confederation-run university, or they can choose to pursue their apprenticeship training and directly enter the workforce.

Continuing education is another area that is seeing growth in regards to medical education and training. With the increase in complex medical processes, the Academy for Medical Training and Simulation (AMTS) (amts.ch), Lucerne, Switzerland, is a one-stop location for continuing medical education and simulator training, eHealth services, knowledge management and health education, as well as a general meeting and conference facility. Led by CEO Dr. Md. R. Zobrist, AMTS offers an independent platform for emulation and analysis of medical processes. Through technology integration, AMTS offers a comprehensive set of pre-operative planning tools – using technology integration – to train and simulate medical professionals in a range of procedures, emergencies, and incidents.

Future

Delivering a vast supply of skilled labor is a strong point for the Swiss manufacturing industry. From the emphasis placed on apprenticeships to the knowledge base grown through academia offerings and continuing education, Swiss manufacturing took its root in precise watch making and even through downturn, reinvented its manufacturing base to yet another thriving industry. Medical technology is a growing market for Swiss-based manufacturing. Offering strong research institutions, heavy support from regional agencies, a flexible set of labor laws, and a tax-friendly infrastructure, the Swiss manufacturing region continues to grow beyond other industrialized nations.

As countries look to compete with Swiss-based manufacturing – working to stay competitive and in the manufacturing game – industrialized nations, and the U.S. in particular, need to consider how to reinvigorate the manufacturing sectors that once thrived, such as automotive – which, although stronger today, remains a smaller sector than in past decades.

As the country is in the process of coming out touch economic times, support from the government, support from regional groups, support from like-minded companies, and support in the R&D sectors through education, training, and workforce development can all deliver a sustainable and growing manufacturing sector.

Just as changes in the watch making market nearly halted Switzerland’s manufacturing sector, it tells a lesson. That challenge was turned into success and is a lesson we can all take to heart.

Explore the January February 2011 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- HERMES AWARD 2025 – Jury nominates three tech innovations

- Vision Engineering’s EVO Cam HALO

- How to Reduce First Article Inspection Creation Time by 70% to 90% with DISCUS Software

- FANUC America launches new robot tutorial website for all

- Murata Machinery USA’s MT1065EX twin-spindle, CNC turning center

- #40 - Lunch & Learn with Fagor Automation

- Kistler offers service for piezoelectric force sensors and measuring chains

- Creaform’s Pro version of Scan-to-CAD Application Module