Medical Device Regulation (MDR) should be at the top of the agenda for medical device manufacturers. By 2020 the new MDR will be fully in force, and businesses not in compliance will have to pull their products from the market. Anecdotal evidence suggests medical device manufacturers have barely started to address MDR, with many unable to prove they have a compliance roadmap in place.

One possible reason for this lack of action is the expectation that the European Commission (EC) may provide an extension. There is no official confirmation of this, and a series of factors - a lack of available compliance professionals and notified body (NB) capacity - suggest medical device manufacturers would benefit to move early to achieve compliance rather than risk getting caught in bottlenecks later.

The life sciences industry faces a well-documented skills-gap, including clinical trial and compliance professionals. Research shows that up to 80% of clinical research professionals work freelance for contract research organizations as opposed to in-house. This poses issues for the industry as a lack of skilled resources will be available. Manufacturers who delay complying with the MDR are going to have minimal options for sourcing talent and will most likely need to pay more due to supply and demand.

Additionally, an NB availability crisis is developing in Europe. Because a 20% decline in number of NBs during the last two years, the situation could worsen as scrutiny is applied to NB processes by competent authorities. The remaining NBs will have to tackle growing demand from manufacturers wishing to certify compliance with the new directive and the pressure of the new inspection requirement for NBs. So, manufactures may not be able to move products into the market fast enough because NBs are too burdened to carry out audits.

Maetrics developed a market opportunity value (MOV) model to demonstrate the potential annual revenues achievable for MDR-compliant manufacturers, or conversely, the scale of the market penalty for non-compliance. The $16.5 billion figure is based on the estimate, confirmed by interviews with major medtech businesses operating in Europe, that compliance under-capacity will be 20% of total market value. This result highlights the importance of early compliance to ensure profitability.

With such a complex and undefined horizon, manufacturers should seek the assistance of professionals right away to help build a plan for their compliance with MDR. Acting earlier than their competitors will allow manufacturers to reap first mover advantage, get their products out earlier, and help avoid any delays when the rush to MDR compliance begins.

Maetrics

www.maetrics.com

Explore the September 2018 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- Kistler offers service for piezoelectric force sensors and measuring chains

- Creaform’s Pro version of Scan-to-CAD Application Module

- Humanoid robots to become the next US-China battleground

- Air Turbine Technology’s Air Turbine Spindles 601 Series

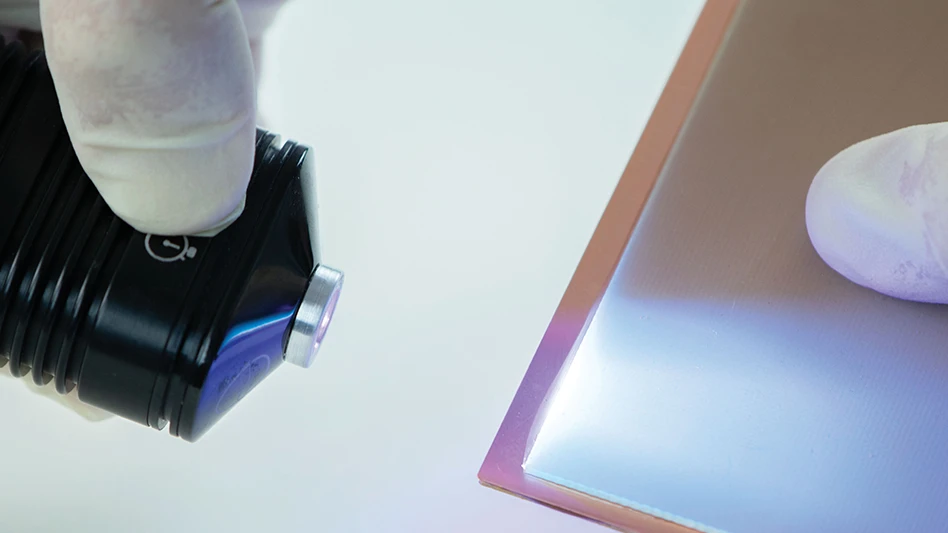

- Copper nanoparticles could reduce infection risk of implanted medical device

- Renishaw's TEMPUS technology, RenAM 500 metal AM system

- #52 - Manufacturing Matters - Fall 2024 Aerospace Industry Outlook with Richard Aboulafia

- Tariffs threaten small business growth, increase costs across industries