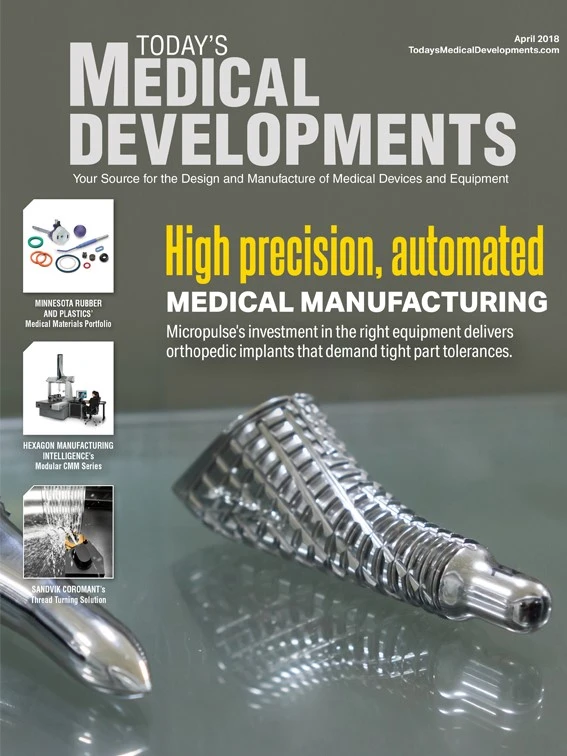

According to McKinsey, mergers & acquisitions (M&A) “continue to be a core growth driver” in 2018 and “will likely see increased activity.” Many other industry analysts are reporting a highly opportunistic transaction (HOT) period for 2018/2019 in medtech M&A.

In this environment – slow-to-market regulatory burdens, rapidly changing market dynamics creating extreme pressures on pricing – organic growth is more challenging than ever before. To implement a long-term growth strategy, it is becoming imperative to include M&A to increase the value of many organizations.

On the other side, it may be the best time to consider selling your medtech company. With the obvious increase of available cash in the market due to U.S. tax reform, more money is available for acquisitions than in most times in history. Additionally, many companies have growth pressures, especially those owned by private equity (PE) firms. This creates opportunity for profitable, legacy medtech companies considering selling.

There are buyers and there is cash! So, if you are considering selling but are worried about value because, you’re only a medtech manufacturer, be assured there is demand.

While the industry buzzes about digital health, artificial intelligence, machine learning, wearables, Big Data, and bioinformatics, there remains no substitute for a good, old-fashioned manufacturing company. Though you may get bonus points if you can tie your manufacturing future to trendy terms.

At MedWorld Advisors, we regularly hear from investors – PE and strategic – looking for quality businesses in developed markets that simply know how to run a profitable medtech manufacturing operation.

Whether you are buying or selling, consciously choose your path if you are determined to manage your process and create your best future value.

If you are looking for inorganic growth, it takes persistence to push through some of the weeds to reach the roses. It’s a competitive market for good targets, so stay patient and work your plan on your focused segments. Build relationships, stay alert, and opportunities will come.

If you are selling, be methodical. Run a confidential process. If you need help, get some M&A expertise on your side. Buyers, PE or strategic, are likely to have M&A executives on their team. Be sure to be able to match their capabilities in process and negotiation skills.

If you wait for an opportunistic approach, be careful what you ask for – as you may find it in today’s HOT market. However, if you haven’t completed strategic planning to understand how it fits into your long-term plans, what sounds good today may be regrettable in the future.

Wishing you organic and inorganic success.

MedWorld Advisors

www.medworldadvisors.com

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the April 2018 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- Siemens accelerates path toward AI-driven industries through innovation and partnerships

- REGO-FIX’s ForceMaster and powRgrip product lines

- Roundup of some news hires around the manufacturing industry

- Mazak’s INTEGREX j-Series NEO Machines

- The Association for Advancing Automation (A3) releases vision for a U.S. national robotics strategy

- Mitutoyo America’s SJ-220 Surftest

- #56 - Manufacturing Matters - How Robotics and Automation are Transforming Manufacturing

- STUDER looks back on a solid 2024 financial year