Vancouver, British Columbia – According to a new report by iData Research, the leading global authority in medical device market research, the U.S. neurovascular market will grow to more than $600 million by 2020. The neurovascular market includes over-the-wire, flow-guided microcatheters, guiding catheters, coil and liquid embolics, neurovascular stents, and flow diversion stents. The market will be driven by the conversion from surgical procedures to endovascular techniques in the treatment of aneurysms and arteriovenous malformations.

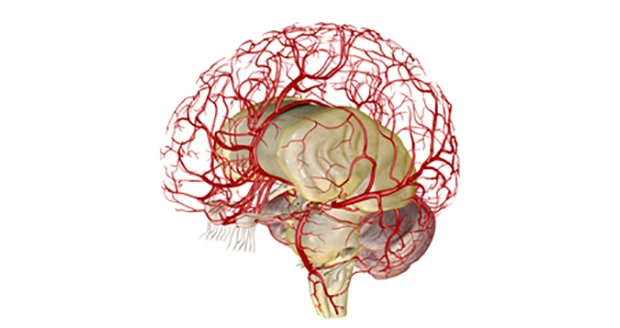

According to the American Heart Association, approximately 3% to 5% of the American population is affected by cerebral aneurysms. Once an aneurysm bleeds, there is a 30% to 40% chance of death and a 20% to 35% chance of moderate to severe brain damage, even if the aneurysm is treated.

Devices used for embolization, a minimally invasive procedure to treat aneurysms, include coil and liquid embolic products as well as neurovascular catheters and guidewires. The increase in volume of embolization procedures will drive these markets over the next few years.

"Previously the market benefitted from the adoption of premium-priced coated coils, however, clinical trials point to a similarity in performance between coated and uncoated devices from leading brands," says Dr. Kamran Zamanian, CEO of iData. However, there is a potential opportunity for smaller competitors to reach the disruptive technologies and change the landscape.

Flow diversion stents are expected to cannibalize a portion of the coiling procedures performed in the U.S. Flow diversion stents have the potential to transform the treatment of aneurysms, replace stent-assisted coiling, and address previously untreatable patients with complex aneurysms. The total neurovascular stent market is expected to experience close to double-digit growth by 2020. Companies involved in the established traditional neurovascular stent market have been rushing to invest in the development of these new products. Covidien's Pipeline device is the first and only flow diversion device approved by the FDA.

Moreover, Covidien recently introduced the first detachable tip neurovascular microcatheter in the U.S. This device allows an increase in the volume of liquid embolic agents used per procedure and improved catheter retrievability. Their recent acquisition of Reverse Medical will expand their presence in the vascular access market. Other key and notable competitors in this market include Codman & Shurtleff Inc., Terumo, and Stryker.

The "2014 U.S. Neuromodulation, Neurovascular, Neurosurgical, and Monitoring Device" market report includes:

- Cerebrospinal fluid (CSF) shunts

- CSF external drainage systems

- Intracranial pressure monitoring devices

- Detachable coils

- Liquid embolics

- Catheters

- Guidewires

- Traditional neurovascular stents and flow diversion stents

- Spinal cord stimulators

- Vagus nerve stimulators

- Sacral nerve stimulators

- Deep brain stimulators

- Gastric electric stimulators

- Neuroendoscopes

- Stereotactic frames

- Stereotactic frameless systems

- Ultrasonic aspirators

- Aneurysm clips

- Neurosurgical microscopes

- Intrathecal pumps

Source: iData Research

Latest from Today's Medical Developments

- Happy Thanksgiving

- Creating the perfect Thanksgiving meal

- Edge Technologies to move into new headquarters

- Optimal Engineering Systems’ AK120-45 Goniometer series

- November Lunch + Learn with Fagor Automation

- 50 years of EMO – a success story

- Formlabs’ Form 4L SLA Printer, Developer Platform

- IMTS 2024 Booth Tour: Okuma America Corp.