COVID-19 highlighted U.S. manufacturing’s strengths and ingenuity – pivoting to testing swabs, PPE, and ventilator production. The pandemic also highlighted some weaknesses – reliance on international supply chains caused production shocks and disruptions. This is still a problem in some areas, such as microchip shortages after manufacturers misread, or simply missed, the pandemic-driven demand for microchips for smartphones, gaming consoles, PCs for work from home, and IT infrastructure upgrades.

This intersection between manufacturing’s strengths and disruptions is the focus of a discussion paper from McKinsey Global Institute (MGI), the business and economics arm of McKinsey & Co. “Building a More Competitive US Manufacturing Sector,” which identifies 16 out of 30 manufacturing industries that can advance “productivity and economic growth, jobs and incomes for workers and communities, innovation and competitiveness, or national resilience.” Most of them contribute to more than one of these goals. The list, alphabetically, is aircraft & defense equipment, autos and parts, basic metals, communications equipment, electrical equipment, electronics, fabricated metals, general machinery, medical devices, other transportation equipment, petrochemicals, pharmaceuticals, precision tools, semiconductors, special-purpose machinery, and specialty chemicals.

In the paper, the authors note those with strong growth prospects include medical devices, semiconductors, communications equipment, and electronics, while medical devices, pharmaceuticals, electronics, and semiconductors have “high intensities of R&D spending, which underpins innovation and competitivenesss.”

So where do industries start? MGI authors suggest beginning with “regaining lost ground,” explaining that while “absolute output has grown, the past two decades have been marked by declines in the U.S. shares of global manufacturing GDP and gross sales.” The slow growth during the past three business cycles has been dramatic: 4.9% in the 1990s down to 1.4% in each of the last two decades along with the U.S. trade deficit in manufactured goods having more than doubled in the most recent decade. This increased dependence on imports “has left some key U.S. supply chains exposed to greater global risks.”

The authors note this erosion reflects competitive dynamics and see four major types of activities in manufacturing that may evolve: Scale-based and standardized; Learning-curve; R&D- and design-driven; Flexible and customizable, with U.S. performance mixed across these activities. In the past 25 years the U.S. share of global manufacturing GDP in R&D- and design-based activity rose 4%, but the nation lost 6% in its global shares in scale-based activity. Flexible activity is down 4% and for learning-curve, while the U.S. excels at conceiving new process innovation, it struggles to scale them up as broadly as other countries, so its share of global GDP has fallen 11%.

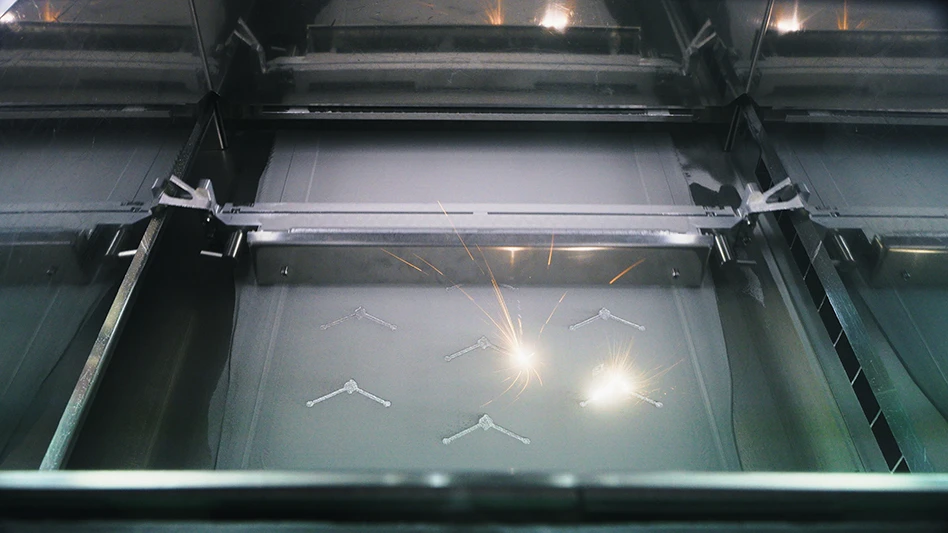

Despite these challenges, the U.S. has the ability to improve its competitiveness and follow the momentum by embracing technological advances such as Industry 4.0, which, as the authors note, “raise productivity by up to 40% and transform some scale-based activity into flexible production.”

What plans do you have to take this momentum and technology to change the future?

Explore the May 2021 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- HERMES AWARD 2025 – Jury nominates three tech innovations

- Vision Engineering’s EVO Cam HALO

- How to Reduce First Article Inspection Creation Time by 70% to 90% with DISCUS Software

- FANUC America launches new robot tutorial website for all

- Murata Machinery USA’s MT1065EX twin-spindle, CNC turning center

- #40 - Lunch & Learn with Fagor Automation

- Kistler offers service for piezoelectric force sensors and measuring chains

- Creaform’s Pro version of Scan-to-CAD Application Module