"IN OCTOBER, THE DELINQUENCY RATE ON MACHINE TOOL LEASES was lower than on home mortgages. Shops are not booming, but are uniformly in good financial shape," commented Harry Moser, President of Agie Charmilles Corp.

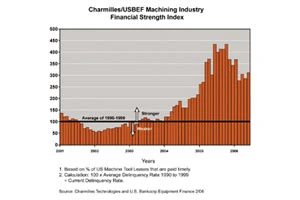

The October 30-day delinquency rate on machine tool leases was about 2%, which is lower than the 2.3% delinquency rate on home mortgages. The Agie Charmilles/USBEF Machining Industry Financial Strength Index was 294 vs. 345 in September 2006, 435 in October 2005, and 55 in January 2002. The January 2002 reading was the lowest reading on record. Any reading above 100 indicates that US Bancorp Equipment Finance's (USBEF's) machine tool lease payment delinquencies are at a rate below the average rate of 1990 to 1999. As profitability rises, liquidity rises, delinquencies fall and the index rises. Historical data is available at the Charmilles URL: www.charmilleus.com/newsroom/bizindes.cfm.

The approximately 126,000 U.S. companies that use machine tools have about 2 million machine tools and 750,000 to1,000,000 directly related employees. Almost all mid-size to large manufacturing companies use, and periodically purchase or lease machine tools. These indices give timely insight into the condition of U.S. manufacturing. The Machining Business Activity Index is a coincident indicator of this key manufacturing sector. The Financial Strength lags business activity and leads capital investment.

Explore the March 2007 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- Arcline to sell Medical Manufacturing Technologies to Perimeter Solutions

- Decline in German machine tool orders bottoming out

- Analysis, trends, and forecasts for the future of additive manufacturing

- BlueForge Alliance Webinar Series Part III: Integrate Nationally, Catalyze Locally

- Robot orders accelerate in Q3

- Pro Shrink TubeChiller makes shrink-fit tool holding safer, easier

- Revolutionizing biocompatibility: The role of amnion in next-generation medical devices

- #56 Lunch + Learn Podcast with Techman Robot + AMET Inc.