"IN APRIL, THE DELINQUENCY RATE ON MACHINE TOOL leases was at an all-time low and about 1/3 of the rate on home mortgages. In contrast to the mortgage market, there do not appear to be many "sub-prime" machine tool leases. Shops are uniformly in good financial shape judged by their ability to pay their bills," comments Harry Moser, President of AgieCharmilles.

The Agie Charmilles Machining Business Activity Index increased to 67 in April from 61 in March. The Index is created by surveying machine tool users concerning their current business level versus three months earlier (January 2007). Any reading above 50 indicates that business activity has improved. The Index was inaugurated in October 2004 and is the only known monthly index of business in U.S. machining industries. Business activity was strongest in the Medical Device Categor y and the Midwest region.

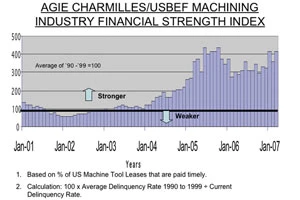

In April, the 30-day delinquency rate on machine tool leases reached the lowest level on record, approaching 1%, which is much lower than the 4.37% credit card (Source: Moody Credit Card Index) or the 4.95% home mortgage delinquency rates (Source: Mor tgage Bankers Association). The AgieChar milles/ USBEF Machining Industry Financial Strength Index was 526 in April vs. 417 in March 2007, 285 in April 2006, 55 in January 2002, the worst reading on record, and 438 in June 2005, previously the best reading on record. Any reading above 100 indicates that US Bancorp Equipment Finance's (USBEF's) machine tool lease payment delinquencies are at a rate below the average rate of 1990 to 1999. As profitability rises, liquidity rises, delinquencies fall and the Index rises.

The approximately 126,000 U.S. companies that use machine tools have about 2 million machine tools and 750,000 to 1,000,000 directly related employees (toolmakers, machinists, operators, programmers, etc.). Almost all mid-size to large manufacturing companies use, and periodically purchase or lease, machine tools. These indices give timely insight into the condition of U.S. manufacturing.

The Machining Business Activity Index is a coincident indicator of this key manufacturing sector. The Financial Strength lags business activity and leads capital investment.

Explore the August 2007 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- LK Metrology acquires Nikon Metrology’s laser scanning and Focus software assets

- Flexxbotics’ robot compatibility with LMI Technologies 3D scanning, inspection products

- IMTS 2024 Booth Tour: Behringer Saws

- UNITED GRINDING Group to acquire GF Machining Solutions

- Mitutoyo America’s Metlogix M3 with the Quick Image Vision System

- IMTS 2024 Booth Tour: Belmont Equipment & Technologies

- Krell Technologies launches Photonics Outreach Program

- Hurco’s TM8MYi lathe