There is no denying that we are experiencing the biggest housing slump in a quarter century, and that energy prices continue to march upward. But from my perspective, things are not as bad as the news media and the politicians want us to believe. Instead of pointing out the positives in our current economy, these moguls are set on talking us into a recession. And worse, we are falling for it. We continue to hear about the loss of jobs in the automotive sector, namely the Big Three. But just how much has been said about the transplants that now build automobiles in the U.S.? That's a little different story.

Additionally, we haven't heard much about the aerospace industry, where sales are projected to grow 6% ($12 billion) to a record $210.6 billion in 2008, and employment is expected to grow for the third consecutive year. Likewise, the news media and one political party, in particular, fails to comment on the positive growth potential of the energy industry. They ignore reports such as one from the American Wind Energy Association (AWEA) that mentions the opening of 14 U.S. manufacturing facilities in 2007, creating new jobs and business opportunities across the country.

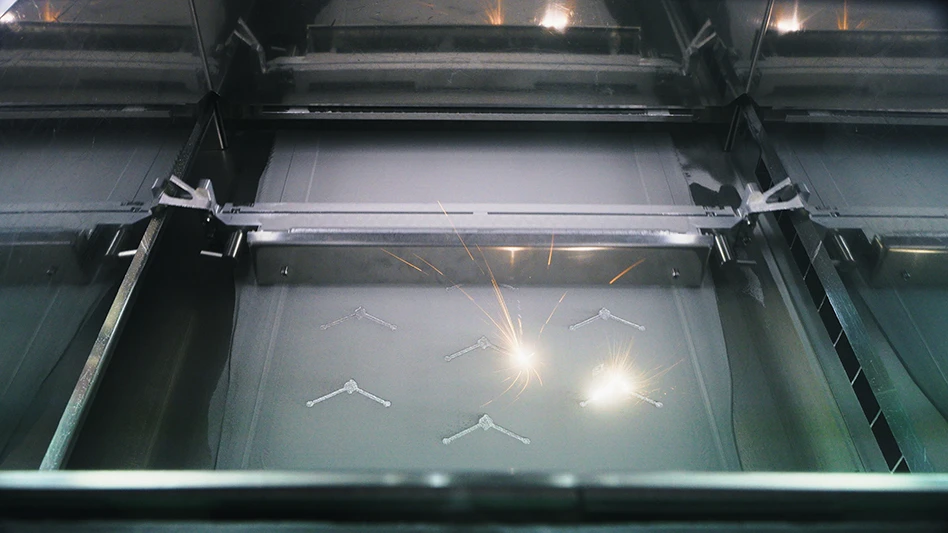

And, if it were not for the continuous push for a national healthcare system, we would not be hearing much of anything concerning the medical industry. I certainly think that the medical device manufacturing sector, with sales now exceeding $90 billion and estimated to grow at a 6% annual rate in the foreseeable future, should get some recognition as an economic stabilizer as well. In fact, it is estimated that 80% of medical device company profits come from products introduced in the last five years and, if we couple this with an aging population, the medical device and equipment manufacturing market has a bright future for years to come.

I'm sure some of you reading this must think I really have my head buried in the sand. However, before you pass final judgment on me, consider what other experts are saying about the situation. For example, the Agie Charmilles Machining Business Activity Index, which is created by surveying machine tool users concerning their current business level versus three months earlier, suggests that while activity has decreased, it is still growing. The continued growth, despite the housing market and oil prices, can be credited to increased exports driven by the lower U.S. dollar, strength in aerospace, power generation, oil field equipment, and medical devices. Also contributing to this is the fact that some work is coming back from China, notes Harry Moser, chairman of Agie Charmilles. In addition, according to their December 2007 Semiannual Economic Forecast, the nation's purchasing and supply management executives predict that economic growth will continue in 2008. Accordingly, the panel of purchasing and supply executives expect a 6.8% net increase in overall revenues this year.

So, let's not be tricked into an economic recession. Instead of falling in with today's doomsayers, we need to understand that while the economy is not great, it is not all that bad.

Explore the May 2008 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- HERMES AWARD 2025 – Jury nominates three tech innovations

- Vision Engineering’s EVO Cam HALO

- How to Reduce First Article Inspection Creation Time by 70% to 90% with DISCUS Software

- FANUC America launches new robot tutorial website for all

- Murata Machinery USA’s MT1065EX twin-spindle, CNC turning center

- #40 - Lunch & Learn with Fagor Automation

- Kistler offers service for piezoelectric force sensors and measuring chains

- Creaform’s Pro version of Scan-to-CAD Application Module