In a world where digital health and AI are buzzwords: what happened to medical device manufacturing? Is it still a positive business to be in? What’s the long-term outlook? What’s the geopolitical climate for this type of manufacturing? Should I continue to invest and grow?

The answer to these questions is a resounding YES. It may not be the flavor of the day or the fashionable darling of our industry. However, medtech manufacturing is still and will continue to be a great business to be in. Medical device manufacturing expects to reach $262.4 billion in 2028 and grow rapidly.

Medical device manufacturers have become so highly sophisticated that their role from pure manufacturing has evolved to being a partner to many of their customers through design, product development, supply chain, regulatory, testing, and more. And, of course, many medical device manufacturers are an integral part of the digital transformation for the medical device industry through value-added solutions provided with their device technology.

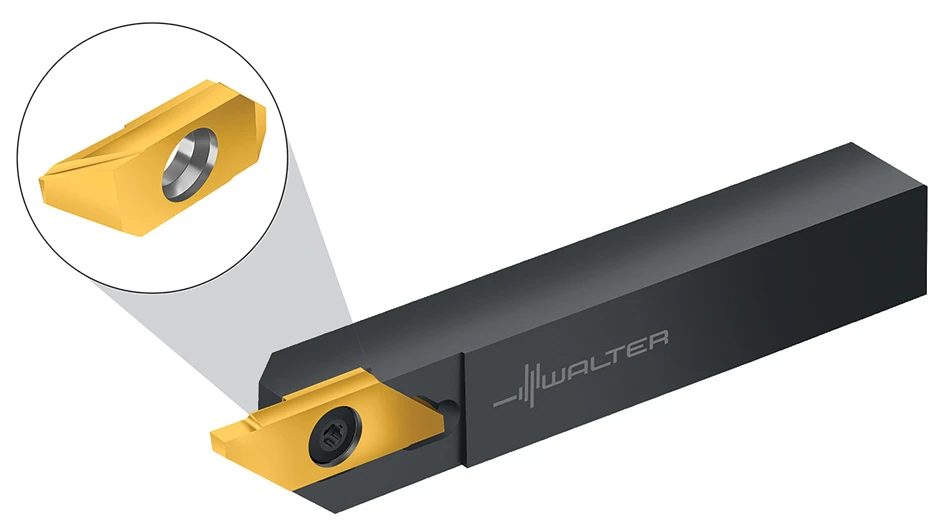

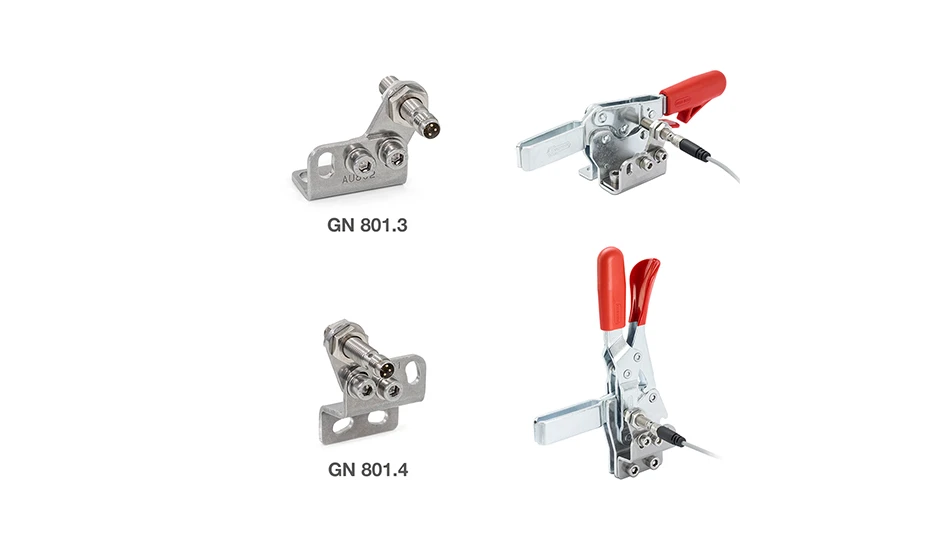

Medical device manufacturing incorporates highly sophisticated technology to create a wide variety of devices such as instruments, monitoring systems, diagnostics, therapeutics solutions, and more. They’re the forefront of innovation in our industry and that shouldn’t be forgotten.

We were reminded during COVID-19 of the important role medical device manufacturers play in our supply chain, and that need going forward is stronger than ever. As M&A advisors, we can tell you that medical device manufacturers are still in very high demand as acquisition targets due to growth opportunities and the profitability of our industry.

What’s changed in recent years is the location of these manufacturing facilities. It used to be that to contain costs you went overseas. Specifically, China was a popular choice. In the meantime, China has become more expensive, and the geopolitical climate makes it a more complicated relationship today than it was in the past. China is still current but looked at more as a localized solution for the Asian market. Vietnam has become the next best thing for manufacturing in that part of the world, but it’ll take time for it to become as efficient as China.

For U.S. medical device manufacturers, the United States is still where the demand lies. Having a manufacturer you can rely on, in your own backyard, is a key strategy for industry leaders looking to reduce risk in bringing products to market.

For U.S. manufacturers, Latin America has become an extension of their facilities to contain costs. Certain countries (e.g., Costa Rica, and the D.R.) have become hot spots for affordable and reliable near-shore manufacturing. Mexico continues to be an option for U.S. companies but the risk to U.S. executives visiting there worries many.

Finally, part of the growth for medtech manufacturing is other manufacturing sectors are encountering some slowdowns due to a variety of factors. More of these manufacturers are looking to expand and stabilize their operation, wanting to enter the medical device market manufacturing stage. Adding to the appeal is historically medtech manufacturing has attractive margins and the need for medical devices isn’t going down any time soon.

Therefore, if you’re a manufacturer of medical devices your future is bright. If you’ve been thinking of adding medical device manufacturing to your portfolio, now is still a great time to join in!

MedWorld Advisors

https://medworldadvisors.com

Explore the September 2023 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- 10 challenges facing the manufacturing industry in 2025

- Optimizing production of high-precision components through collaboration

- An inside look at the defense maritime industrial base

- Why manufacturing, intralogistics companies need to embrace the cloud

- February 2025 US cutting tool orders total $198.6 million

- The Smoothest Surfaces For Your Toughest Materials

- Extraordinary Starts Where Limits End | Okuma

- DISCOVER MORE WITH Mazak Northeast event