Growth remains steady

A $587 billion industry

Medtech recorded its 6th successive year of topline growth

Artificial intelligence (AI)

Use cases are emerging across the medtech value chain

Innovation

2023 was a record year for FDA product approvals; highly differentiated new launches in areas such as cardiovascular, robotics, radiology

5 key areas strengthening the industry’s transformation, positioning medtech industry for future success:

1. Search for high-growth opportunities

2. Cost optimization measures

3. Adapting revitalized commercial models

4 Harnessing AI for significant growth, competitive advantage

5. Capitalizing on direct-to-consumer market

Other key findings:

2023 – Profits nearly doubled year-over-year; the $12.5 billion the industry claimed in 2022 was a 5-year low

R&D – Expenses remain between 5% and 6% of total revenues for the last 5 years ($33.2 billion for 2023), selling, general, and administrative (SG&A) expenses ate up 22% of revenues in 2023 ($127.2 billion)

Growth/decline – Commercial leaders recorded 14.3% top-line growth; emerging leaders (revenues below $500 million) experienced a 9.1% revenue decline due to a constrained financing environment

Innovation capital – The amount of investment going to medtechs represented 44% of the financing raised by medtech during the 12-month period. At the height of investor interest in medtech during COVID-19, innovation capital represented 67% of medtech financing, hitting $28.5 billion between July 2020 and June 2021; total for 2024 is only 42% of this figure

Download the report: https://www.ey.com/en_us/life-sciences/pulse-of-medtech-industry-outlook

Explore the January/February 2025 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

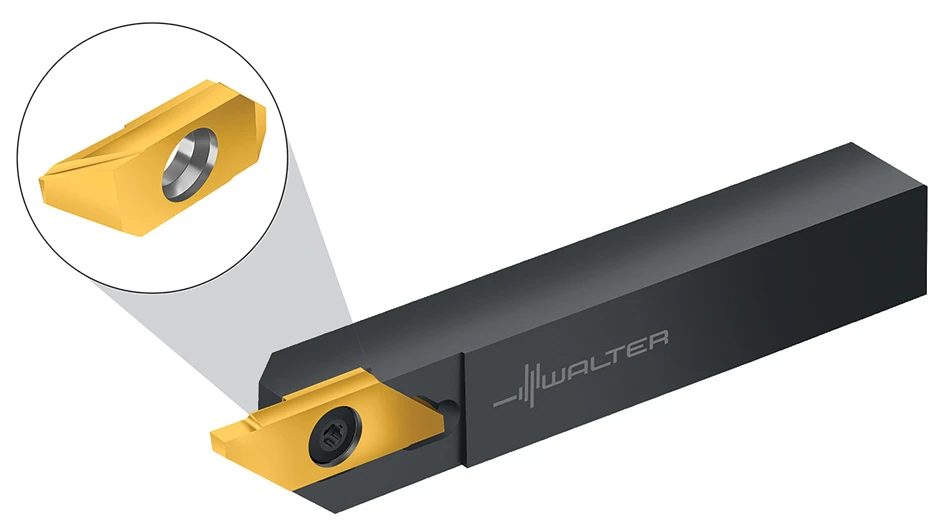

- Strategies to improve milling and turning for medical components

- Being proactive about your business despite uncertainty

- 10 challenges facing the manufacturing industry in 2025

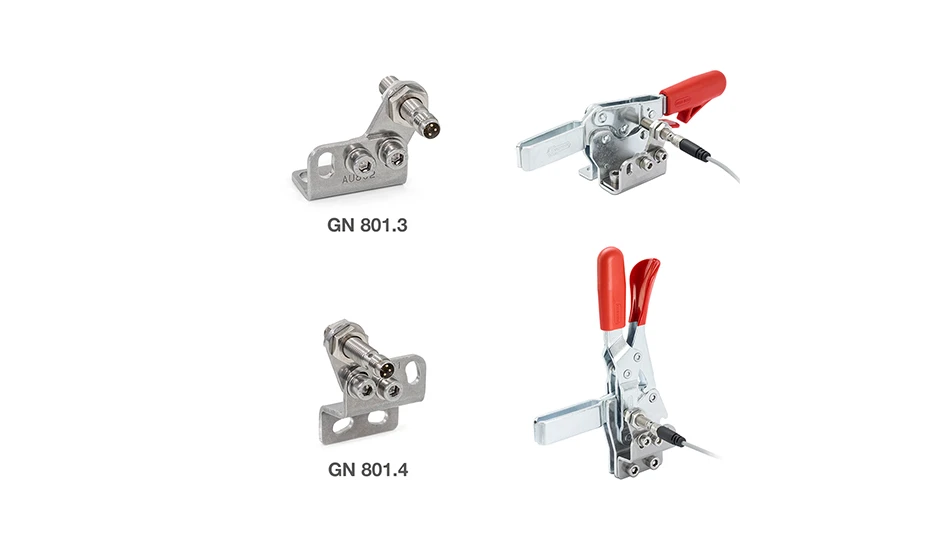

- Optimizing production of high-precision components through collaboration

- An inside look at the defense maritime industrial base

- Why manufacturing, intralogistics companies need to embrace the cloud

- February 2025 US cutting tool orders total $198.6 million

- The Smoothest Surfaces For Your Toughest Materials