USCTI

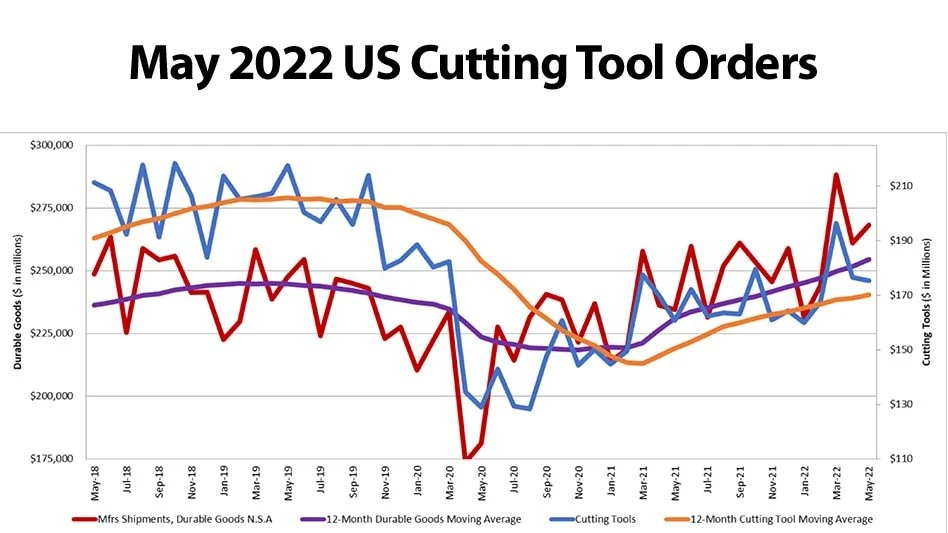

May 2022 U.S. cutting tool consumption totaled $175.4 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 0.6% from April’s $176.5 million and up 9.1% when compared with the $160.7 million reported for May 2021. With a year-to-date total of $875.8 million, 2022 is also up 9.1% when compared to the same time period in 2021.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

“The May numbers are very similar to April and seem to send the same message: that manufacturing continues to struggle with the issues of inflation, the supply chain disruptions, and the shortage of human resources,” comments Brad Lawton, chairman of AMT’s Cutting Tool Product Group. “Again, to sum it up with an overused word, ‘uncertainty’ will remain with us for an extended period of time.”

Pat McGibbon, AMT’s chief knowledge officer, has a more positive outlook on the industry, saying, “Leading indicators point to a bright finish for the cutting tool market this year after the sector’s seasonal softening in July and August. Manufacturing capacity utilization remains over 80%, and the Institute for Supply Management’s PMI index is at 53; both of which signal continued expansion in the manufacturing sector. Growing backlogs and delivery rates of manufacturing technology equipment will yield a significant expansion in manufacturing capacity. This surge in production capacity will support continued growth in cutting tool shipments through early 2023.”

Latest from Today's Medical Developments

- MedTech Innovator welcomes five new industry partners

- First Article Inspection for quality control

- The manufacturing resurgence is here – are you ready?

- Workholding solutions for your business

- ZOLLER events will showcase the company’s cutting-edge innovations

- THINBIT’s MINI GROOVE ‘N TURN Acme threading inserts

- CMMC Roll Out: When Do I Need to Comply? webinar

- Metabolic research uses Siemens gas analyzers to deliver results with 99.9999% resolutions