Manufacturers Alliance/MAPI Quarterly Industrial Outlook – Fourth Quarter 2007, authored by Chief Economist Daniel J. Meckstroth, provides a detailed look at the health of the domestic manufacturing sector and reviews the performance of a selected group of its most important subsectors. In addition, a two-year forecast of growth in 24 of the 27 subsectors is included. A few highlights of the report follow.

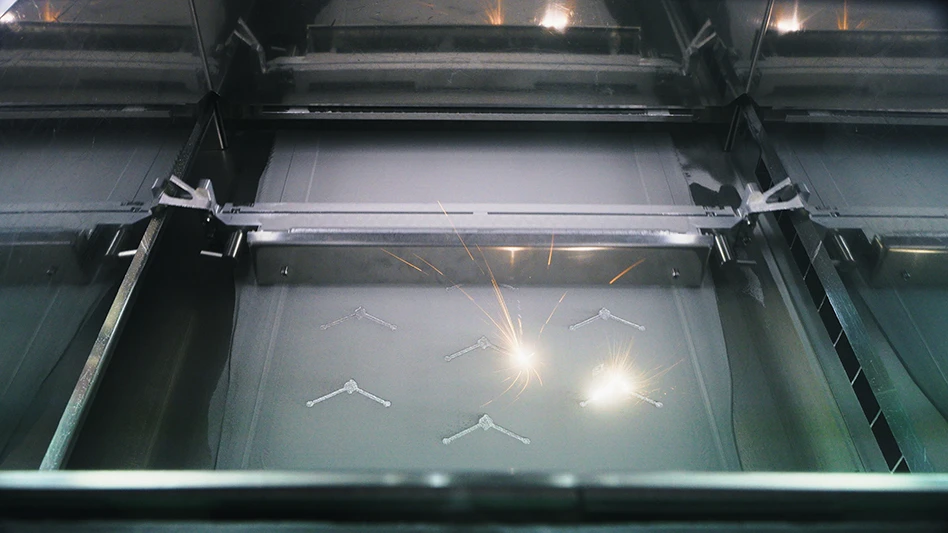

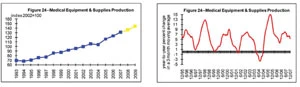

Medical equipment and supplies production is made up of surgical and medical instruments, surgical appliances and supplies, and dental laboratories. The industry has a relatively consistent record of growth, with trated in surgical and medical instruments. Surgical appliances and supplies are growing modestly, and dental laboratory production is declining. Medical equipment and supplies is relatively balanced in its trade account; imports about equal exports. In 2007 exports and imports both increased 11%. Medical equipment and supplies production is expected to grow 3% in 2008 and 7% in 2009.

Metalworking machinery, consisting of industrial molds; metal cutting and forming machines; special tools, dies, jigs, and fixtures; and miscellaneous metalworking machinery, posted only 1% growth in Q4 for production activity – mirroring the meager growth achieved medical equipment and supplies production up 5% in the fourth quarter. Although medical equipment and supplies production generally is growing, its growth rate is cyclical. Within the industry, growth is currently concenfor the year as a whole. Industrial molds and metal cutting and forming machine tools grew at a modest pace. The trade deficit in overall metalworking machinery has widened, as exports fell 4% but imports increased 29% in 2007. An industrial recession will reduce metalworking machinery production 1% in 2008 and the industry is forecast to post 4% growth in 2009.

To order the full report, visit mapi.net/source/Orders/index.

Do you know someone that has made a positive impact in the horticulture industry? Nominate them for a Horticultural Industries Leadership Award (HILA)!

| SUBMIT NOMINATION |

Explore the May 2008 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- HERMES AWARD 2025 – Jury nominates three tech innovations

- Vision Engineering’s EVO Cam HALO

- How to Reduce First Article Inspection Creation Time by 70% to 90% with DISCUS Software

- FANUC America launches new robot tutorial website for all

- Murata Machinery USA’s MT1065EX twin-spindle, CNC turning center

- #40 - Lunch & Learn with Fagor Automation

- Kistler offers service for piezoelectric force sensors and measuring chains

- Creaform’s Pro version of Scan-to-CAD Application Module