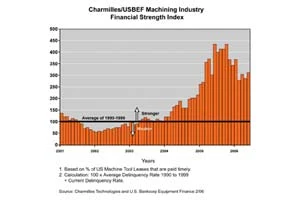

The Charmilles/USBEF Machining Industry Financial Strength Index was started in October, 2004 and is made up of reactions to a survey of machine tool users about their current business levels versus the previous three months. "The U.S. economy is clearly reacting to high interest rates and oil prices," observes Harry Moser, president of Agie Charmilles Corp. "Tooling (molds, stamping dies and extrusion dies) appears to be holding up better than production. If the recent weakening of the U.S. dollar continues and the Federal Reserve does not attempt to strengthen the dollar with higher interest rates, long term manufacturing growth is likely." Looking at the figures, historical data shown in Figure 1 is a Financial Strength Index. As Charmilles explains, any reading above 100 indicates that U.S. Bankcorp Equipment Finance's (USBEF's) machine tool lease payment delinquencies (a good measure of liquidity and consistent profitability) are at a rate below the average rate of 1990 to 1999. As profitability rises, liquidity rises, delinquencies fall and the Index rises. Figure 2's Machining Business Activity Index is based on data available for it – and for Figure 1 – that's available for viewing at the Charmilles web site: www.$1.com/ newsroom/bizindex.cfm. For the chart, any figure above 50 indicates an improvement in business activity.

Explore the September October 2006 Issue

Check out more from this issue and find your next story to read.

Latest from Today's Medical Developments

- Dassault Systèmes enters next phase of Living Heart Project with AI-powered virtual twins

- Bruker’s X4 POSEIDON advanced X-ray microscope

- #53 - Manufacturing Matters - 2024 Leaders in Manufacturing Roundtable

- Festo Incredible Machine celebrates its premiere at the Hannover Messe

- Join us for insights on one of the hottest topics in manufacturing!

- Turnkey robotic systems are already behind the times

- You can still register for March’s Manufacturing Lunch + Learn!

- HERMES AWARD 2025 – Jury nominates three tech innovations